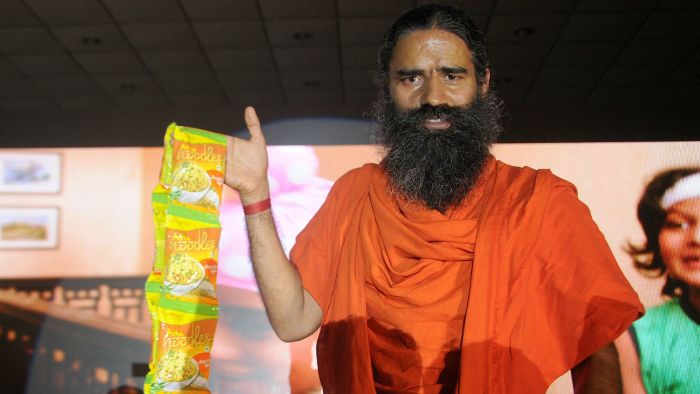

One of the more difficult yoga poses in the shirshasana, or headstand of Baba Ramdev and this became the fault poster for India's consumer staples industry.

Gadfly first wrote about Baba Ramdev a year ago, "The mystic whose food and personal care empire offers salavation from toxic chemicals had already evolved from a fad to an emerging long term threat to Colgate Palmolive India Ltd and Hindustan Uniliver Ltd.”

Colgate, whose supply chain is not effected by India's cash ban, might still struggle to avoid losing market share to Ramadev.

This month, Patanjali won a two-notch credit rating upgrade from ICRA, the India affiliate of Moody's Investors Service. So far, the company has just $47 million in borrowings. But the business is reaching an inflation point.

Patanjali's 2016 net profit margin stands at 16%.About 30 per cent of its revenue is comes from toothpaste,honey ,clarified butter,soap and gooseberry juice, and the other 70 per cent on noodles and hair oil and rose sherbet.From a working capital perspective , that's an expensive product portfolio to sustain.If Patanjali continues to remain light on fixed assets, it will have to outsource more of its manufacturing.

To researcher at Frost & Sullivan , the "Patanjali effect" is one of the consumer trends that defined India food in more health and hygiene along with many other products. Now others are rushing to mimic Ramdev's traditional twist on modern living. Without a capital infusion, the guru's profitability could start waning.