GST has been a hot topic among the mass since so many days. Its been a year GST came into existence but still many people don’t what GST is and how it works. GST -goods and service tax bill, it is difficult for the business people to involve GST easily to their working system. All are trying hard to update their working systems and trying to manage the bill including GST.

Today we are going to tell you about 4 easy tools which will help you work with GST.

Tally connector by clear tax

Previously, businesses using Tally had to manually download the accounting data from Tally and upload it to the GST to file their returns.T ally connector helps users rectify any errors instantly, hence making the process seamless and time-efficient. Once the data is in Clear tax, data validation and GST return filing is super easy and can be done within minutes, reducing both time and effort spent.

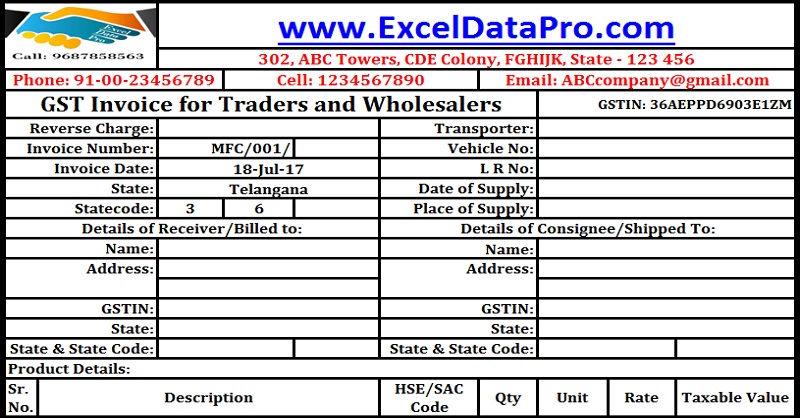

Excel Format by GST

Traders and businesses can upload sales data on GST portal with the help of an offline Excel format, launched by the Goods and Services Tax Network. The offline Excel template has eight worksheets, making collating all invoices easy for taxpayers.

GST App by BSNL

Bharat Sanchar Nigam Limited recently launched its GST app to ease out the tax filing process for small traders. Businesses can enjoy this plan free-of-cost for up to 2,000 invoices. For bills between 2,000 and 6,000 businesses would have to pay an annual fee of Rs. 1,999. Invoices above 6,000 would warrant Rs 1 per invoice.

Airtel GST Advantage

Airtel Business has launched Airtel GST Advantage. As a solution, Airtel GST Advantage aims to help small and mid-sized businesses file GST returns. It provides users with a help desk to handle any queries, an addition 18 GB data to be used over three months and an easy access to tax filing services of Clear Tax.

Bad credits of nearly $7 billion on big PSU banks finds Regulators