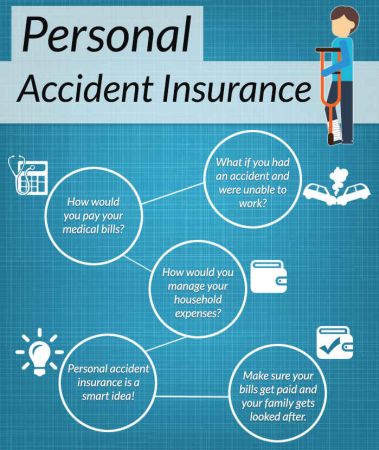

ith increasing awareness now a large number of people have started taking health insurance and life insurance but do not take Accidental Insurance (Accident Insurance). While it is becoming almost necessary due to the accidents of road accidents including road and rail accidents. Today we are telling you why to take personal accident insurance and how it is beneficial to you.

In the first Global Status Report on Road Safety of the World Health Organization (WHO), it has been stated that there are more than 130,000 deaths worldwide in a year in road accidents. The condition of a road accident is the worst here and 14 people die per hour.

The premium of the policy is determined by your business and income. This also determines how much you can get the maximum personal accident cover. For example, a pilot has to pay more premium than any other corporate employee. This is due to the nature of his business. Although this is less important for those who do not live at home or travel longer. Personal Accident Policy is economical. Premium cover of Rs. 10 lakhs is between Rs. 1500 and Rs. 3000.

In addition to the basic package, many other plans are also available in the market as per facility. Family package covers, couples, and dependent children can be covered under a single policy and there is a discount on premium also. Group Personal Accident Policy is also available for specific groups, in which there is a discount in premium on the basis of group size.

Also Read:

Income Tax Department will take action against one lakh people

Things Alauddin Khilji did to reform economy under his reign

People most dissatisfied with online customer product