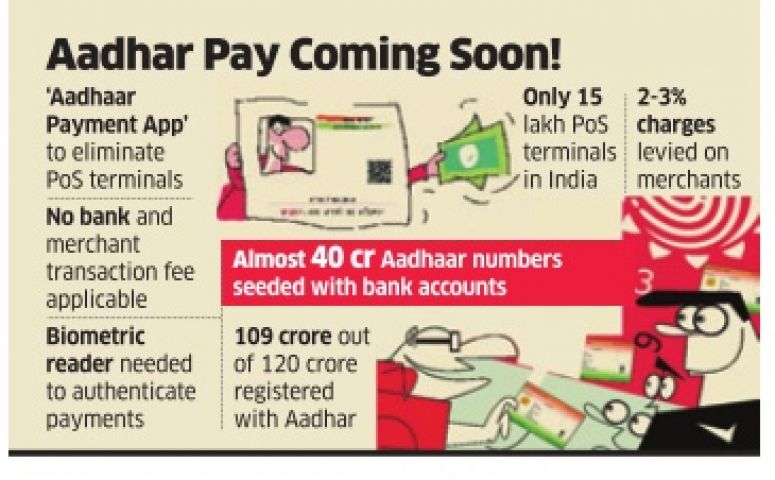

Prime Minister Narendra Modi is concocting an Aadhaar Payment App' that could hush computerized payments faultfinders. The new application would get rid of plastic cards and the purpose of offer machines once accepted to be fundamental for a less money society.

The application, to be propelled on December 25, would likewise dispose of the charge payments for specialist organizations like card organizations, for example, Mastercard or Visa, which has been a hindrance in vendors changing to advanced payments making it moderate to even traders in remote towns, said individuals acquainted with the improvement. All that it needs is an Android telephone with the dealer.

How can it function?

Traders need to download the Aadhaar cashless dealer application on their cell phones associated with a biometric peruser, which is as of now accessible for Rs 2,000.

The client will then encourage his or her Aadhaar number into the application, select the bank through which the exchange will occur, and the biometric output will fill in as a watchword for the exchange to be confirmed.

"This application can be utilized by a man to make payments with no telephone," Unique Identification Authority of India (UIDAI) CEO Ajay Bhushan Pandey told ET. "Very nearly 40 crore Aadhaar numbers as of now stand connected to ledgers - that is a large portion of the grown-ups in India. The point is to connection all Aadhaar numbers with financial balances by March 2017."

The legislature, alongside the controller and payments organizations, is attempting to guarantee that the target of making advanced payments a reality the nation over. IDFC Bank alongside UIDAI and National Payments Corporation of India have built up this application which would be propelled at the national level on Sunday.

Sensex, Nifty close lower as Fed signals three more hikes...