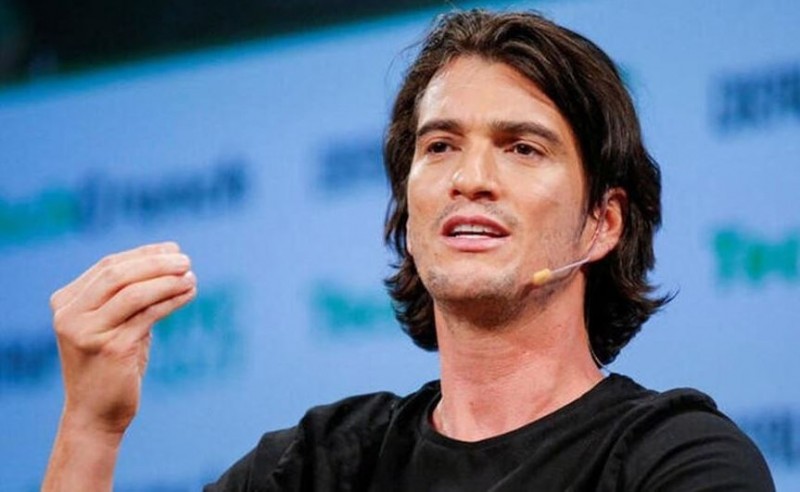

Adam Neumann, the notoriously fired founder of WeWork in 2019 for financial fraud, mismanagement, and fostering a toxic work environment, might attract a sizable sum of money once more, particularly in a weak market for venture capital and for a firm that hasn't even begun.

(a16z), well-known for its early investments in Twitter and Airbnb, announced a USD 350 million pre-seed investment in Neumann's startup Flow, valuing the soon-to-be-established residential real estate company at USD 1 billion (unicorn).

While the deal's financial terms were not disclosed in a16z's official blog post, the NYT estimated that it was worth USD 350 million, citing unnamed sources. This is the largest check that a16z has ever given to a founder in a single round.

Marc Andreessen, co-founder and general partner at the VC firm, explained its bet on Neumann, who botched up WeWork's IPO and oversaw its decline from a lofty valuation of USD 47 billion to the current USD 4 billion, saying, "Adam is a visionary leader who revolutionised the second largest asset class in the world --commercial real estate -- by bringing community and brand to an industry in which neither existed before."

According to its rudimentary website, low, which is expected to debut in 2023, plans to manage more than 3,000 apartment buildings Neumann has acquired in Miami, Fort Lauderdale, Atlanta, and Nashville. It will also provide residents with a branded rental housing experience and community living features. According to DealBook, this service will be made available to independent developers as well.

A16z believes the housing sector is ready for disruption and expects "repeat founders" like Neumann to build on their prior triumphs as remote working develops significantly in a post-pandemic future.

"We recognise how challenging it is to create something of this calibre, and we adore watching repeat creators improve on prior triumphs by learning from mistakes... Horowitz added, "For Adam, the successes and lessons are plenty and we are excited to go on this journey with him building the future of living. This requires rethinking the entire value chain, from the way buildings are bought and owned to the way residents interact with their buildings to the way value is distributed among stakeholders.