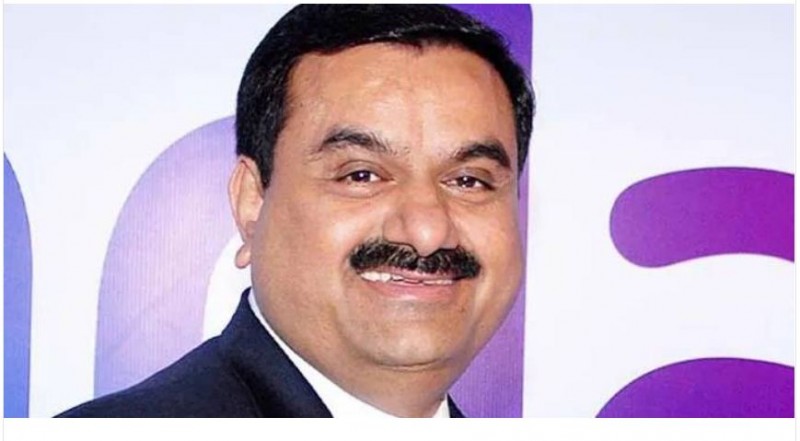

Gautam Adani's company announced on Sunday that it has reached an agreement to buy a majority stake in Holcim Ltd's Indian assets for USD 10.5 billion, marking the ports-to-energy conglomerate's foray into the cement industry. Ambuja Cements Ltd, as well as related assets, will be acquired by the Adani Group for 63.1 percent. ACC Ltd, one of Ambuja's local subsidiaries, is also publicly traded.

"Through an offshore special purpose vehicle, the Adani Family announced that it has entered into formal agreements for the acquisition of Holcim Ltd's full stake in two of India's major cement companies, Ambuja Cements Ltd and ACC Ltd," the group stated. Holcim owns 63.19 percent of Ambuja Cements and 54.53 percent of ACC through its subsidiaries (of which 50.05 per cent is held through Ambuja Cements). "The total value of the Holcim holding and open offer consideration for Ambuja Cements and ACC is USD 10.5 billion, making this Adani's largest-ever acquisition and India's largest-ever infrastructure and materials M&A deal," according to the announcement.

"The equivalent offer share prices of Rs 385 for Ambuja Cement and Rs 2,300 for ACC equate into cash proceeds of CHF 6.4 billion (Swiss Franc) for Holcim," Holcim said in a statement. Adani has expanded beyond its primary business of operating ports, power plants, and coal mines in recent years to include airports, data centres, and clean energy.

Adani Group's statement came on the news of being made a Rajya Sabha MP

Gautam Adani loses big due to fall in stock market

Adani Airport Holdings raises USD250-mn for development of airports