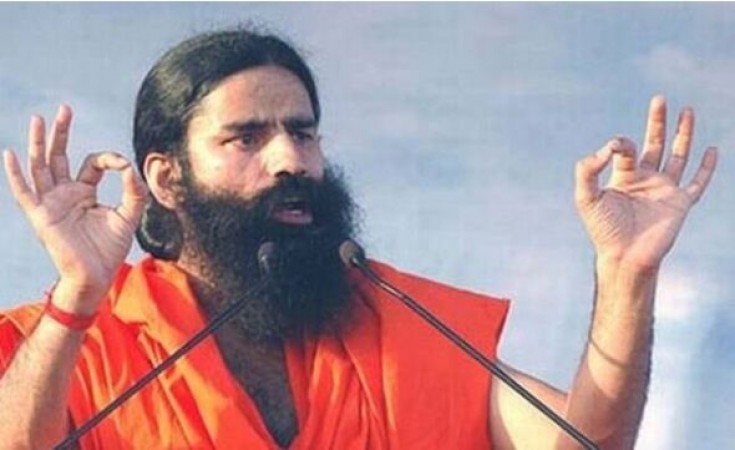

New Delhi: In the era of Initial Public Offering (IPO), the Follow-on Public Offering (FPO) of Baba Ramdev's Ruchi Soya is being discussed fiercely. The matter has reached the Delhi High Court. Actually, the promoters of Ruchi Soya are bringing an FPO of Rs 4,300 crores to reduce their stake. In such a situation, the question in the minds of many people is that what is FPO and how different it is from IPO.

Let us tell you that in the language of the stock market, FPO i.e. Follow-on Public Offering is also called Second Public Offering. In fact, when a company is already listed on the stock exchange and sells its shares through the market to raise funds, it is called follow-on public offering. In this, those investors can also buy shares, who have already bought shares of the company. In this, both old and new investors get an opportunity to buy shares and earn profit.

On the other hand, if we talk about IPO, then it is called Initial Public Offering. Under this, the company is listed on the stock market for the first time to raise capital, for this, it has to first get approval from the Securities and Exchange Board of India (SEBI). Only after that, the company brings its shares to the market for listing. IPO can be completed by fixed price or book building or both. In a fixed price, the price at which the shares are offered is predetermined. Book building determines the price range for the shares within which investors place bids.

NHAI to be flag-bearer of Govt’s Rs.6-La Cr. asset monetisation plan

MCX Gold watch: Gold nearly Rs 300 per 10 gram, silver crosses Rs 63K mark