Amid uncertainty generated by the surge in coronavirus situations, the Reserve Bank of India (RBI) is likely to maintain the status quo at its subsequent financial coverage evaluate and look ahead to some extra time earlier than taking any motion to spur progress.

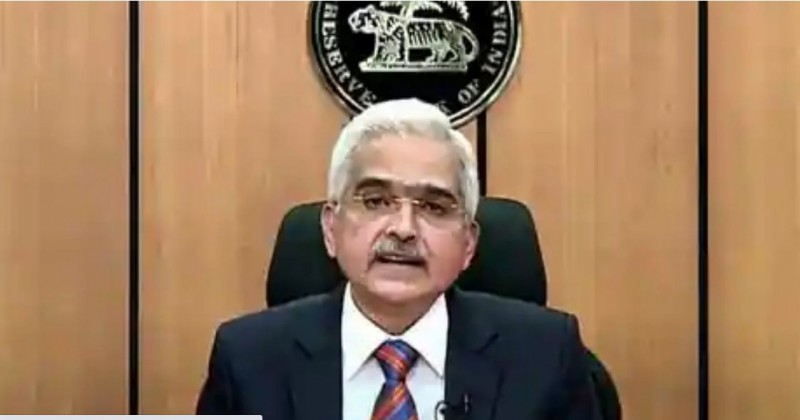

The Central Bank is slated to announce its first bi-monthly financial coverage of the 2021-22 fiscal on April 7, 2021 after a 3-day assembly of the Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das. On February 5, after the final MPC meet, the central financial institution had stored the important thing rate of interest (repo) unchanged citing inflationary considerations.

According to consultants, the Reserve bank is likely to proceed with the accomodative financial coverage stance and look ahead to an opportune time to announce financial motion with a view to guarantee the very best consequence in phrases of pushing progress with out sacrificing the primary goal of containing inflation.

In a report, Dun & Bradstreet mentioned the latest surge in the COVID-19 circumstances and the restrictions imposed by a number of states will impose additional uncertainty and hurdles to the tempo of revival of business manufacturing.

Dun & Bradstreet Global Chief Economist Arun Singh mentioned long-term yields are hardening, main to rise in borrowing prices.

“In this context, RBI faces the troublesome job of managing the inflationary pressures whereas stopping an increase in the borrowing price. “Despite the rising inflationary pressures, we expect the RBI to keep the policy repo rate unchanged in the forthcoming monetary policy review in view of the uncertainty posed by the sharp rise in COVID-19 cases,” he mentioned.

Fitch Ratings upgrades India’s FY22 GDP growth forecast to 12.8 percent

IMF's big statement on Indian economy, regarding recovery

Covid19 Pandemic pushes back India’s USD 5-trillion GDP target by 3 years to FY32: Report