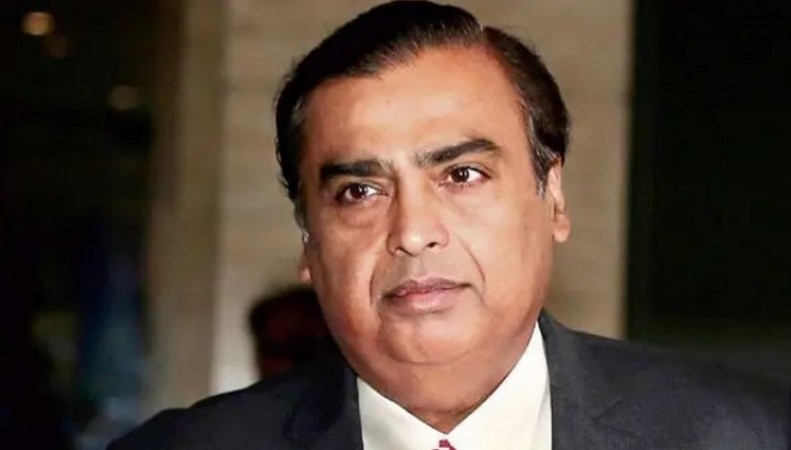

The Securities Appellate Tribunal has invalidated the 2021 ruling by the Securities and Exchange Board of India (Sebi) against Mukesh Ambani, managing director of Reliance Industries Ltd, Navi Mumbai SEZ, and Mumbai SEZ. The case revolves around alleged manipulative trades in Reliance Petroleum Ltd shares.

In January 2021, Sebi imposed fines of Rs25 crore on Reliance Industries and Rs15 crore on Mukesh Ambani. Additionally, Navi Mumbai SEZ was directed to pay a penalty of Rs20 crore. Ambani, along with Reliance Industries and other entities, contested this order before the Securities Appellate Tribunal.

A panel led by Justice Tarun Agarwala declared that "Sebi's 2021 order is nullified. If any penalties were previously remitted to Sebi, they are to be reimbursed to the appellants."

The case involves the trading of RPL shares in both cash and futures segments in November 2007. Subsequently, Reliance opted to sell nearly 5% of its stake in RPL, a listed subsidiary that merged with RIL in 2009.

Sebi's adjudicating officer BJ Dilip had asserted that any manipulation in the volume or price of securities undermines investor trust in the market. "In this instance, ordinary investors were unaware that RIL was behind the F&O segment transactions. The execution of fraudulent trades impacted the price of RPL securities in both cash and F&O segments, harming the interests of other investors," he stated in the ruling.

Sebi's order also indicated that RIL was involved in a scheme of manipulative trading concerning the sale of its 5% stake in RPL. It was mentioned that before executing cash segment sale transactions, RIL had secured substantial short positions in RPL November futures through 12 agents, bypassing position limits for a commission payment.

Consequently, RIL allegedly dominated nearly 93% of open interest in RPL November Futures through the agents' short positions in the F&O segment. Sebi's order claimed that Navi Mumbai SEZ and Mumbai SEZ provided funding for the margin payments by these agents.

Bharti Telecom Eyes Record Rupee Bond Issuance of $961 Million in India