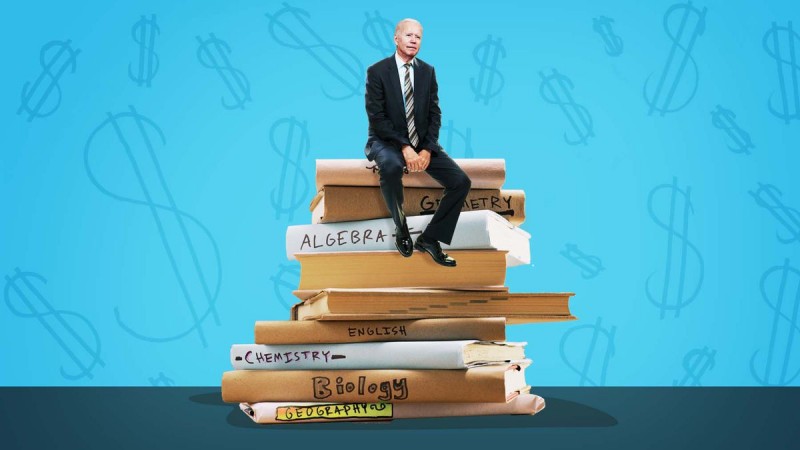

For many students, pursuing higher education is a dream come true, but it often comes with the burden of student loans. The rising cost of education has left countless graduates struggling to repay their loans after graduation. However, there is hope in the form of student loan forgiveness programs. In this article, we will explore how to apply for student loan forgiveness and the different programs available to borrowers.

Understanding Student Loan Forgiveness

Student loan forgiveness is a government program that allows borrowers to have all or a portion of their student loans forgiven, meaning they are no longer required to repay the remaining balance. These programs are designed to provide relief to individuals facing financial hardships and who meet specific eligibility criteria.

Types of Student Loan Forgiveness Programs

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness program is intended for individuals working in public service jobs. If you work for a government or non-profit organization and make 120 qualifying monthly payments, you may be eligible to have the remaining balance of your federal Direct Loans forgiven.

Teacher Loan Forgiveness Program

Teachers who work full-time in low-income schools and have Direct Subsidized or Unsubsidized Loans may qualify for the Teacher Loan Forgiveness Program. To be eligible, teachers must teach for five consecutive years at a qualifying school.

Income-Driven Repayment Forgiveness

Borrowers on income-driven repayment plans may be eligible for forgiveness after making payments for 20 to 25 years, depending on the specific plan. Any remaining balance at the end of the repayment period can be forgiven.

Closed School Discharge

If your school closes while you're enrolled or shortly after you withdraw, you may be eligible for a closed school discharge. This forgiveness option applies to Direct Loans, Federal Family Education Loans (FFEL), and Federal Perkins Loans.

Total and Permanent Disability Discharge

Borrowers with a total and permanent disability may be eligible for loan discharge. To qualify, you must provide documentation of your disability from a physician.

Borrower Defense to Repayment

This forgiveness program applies to borrowers who were defrauded by their school or whose school engaged in certain misconduct. To be eligible, borrowers must submit a claim and meet specific requirements.

Eligibility Criteria for Student Loan Forgiveness

To apply for student loan forgiveness, you must meet certain criteria:

Federal Student Loans

Most student loan forgiveness programs apply only to federal student loans, including Direct Loans, FFEL Loans, and Perkins Loans.

Employment Requirements

Many forgiveness programs require you to work in a specific field or for a qualifying employer for a set period.

Repayment Plans

For income-driven repayment forgiveness, you must make payments under an eligible repayment plan.

Step-by-Step Guide to Applying for Student Loan Forgiveness

Follow these steps to apply for student loan forgiveness:

Step 1: Check Your Loan Type

Determine if you have federal student loans eligible for forgiveness.

Step 2: Ensure You Meet the Employment Requirements

Review the employment criteria for the forgiveness program you're interested in.

Step 3: Select the Right Repayment Plan

Choose an income-driven repayment plan if applicable.

Step 4: Submit Employment Certification

Certify your employment with a qualifying employer.

Step 5: Make Timely Payments

Ensure you make all necessary payments on time.

Step 6: Complete the Forgiveness Application

Submit the forgiveness application accurately and on time.

Tips for a Successful Application

Keep detailed records of your employment and payments.

Stay informed about the latest updates and changes to forgiveness programs.

Seek assistance from your loan servicer or a student loan counselor if you have questions.

Common Mistakes to Avoid

Missing deadlines for certification and application submissions.

Failing to meet employment requirements during the forgiveness period.

Neglecting to choose an eligible repayment plan.

The Pros and Cons of Student Loan Forgiveness

Pros

Significant reduction in student loan debt.

Relief from financial burden.

Opportunity to work in public service or other eligible fields.

Cons

Potential tax implications for forgiven amounts.

Limited eligibility for certain professions.

Long processing times for forgiveness applications.

Alternative Options for Managing Student Loan Debt

If you don't qualify for student loan forgiveness or need additional assistance, consider these options:

Income-Driven Repayment Plans

Loan Consolidation

Student Loan Refinancing

Forbearance and Deferment

Applying for student loan forgiveness can be a game-changer for borrowers struggling with hefty student loan debt. Understanding the eligibility criteria and following the application process diligently can lead to significant debt relief. However, it's essential to explore all options and carefully consider the pros and cons before making a decision.

How to Write a Resume: Crafting an Effective Document for Job Applications

Understanding Anxiety: A Comprehensive Guide to Managing the Invisible Struggle