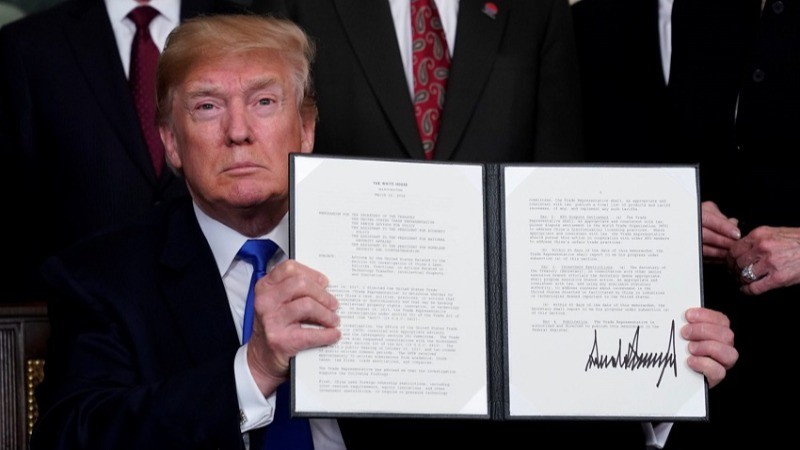

Former U.S. President Donald Trump, the Republican presidential nominee, has introduced a bold plan to impose a 100% tariff on goods from nations that stop using the U.S. dollar for international trade. This initiative is part of Trump’s larger agenda to counteract efforts by countries like China and India to reduce their reliance on the dollar, commonly referred to as "de-dollarization." Trump stressed his commitment to preserving the dollar’s global supremacy during a recent rally.

"If you abandon the dollar, you’re not doing business with the United States because we will impose a 100 percent tariff on your goods," Trump said at a rally in Wisconsin, underscoring his firm stance on protectionism and economic nationalism.

Concerns Over Dollar’s Global Role

This announcement follows extensive consultations with Trump’s economic team, who have considered several ways to penalize countries that trade in currencies other than the U.S. dollar. His team has explored measures like export controls, accusations of currency manipulation, and higher tariffs. Trump’s primary concern is maintaining the dollar's central role in global trade, which has been facing growing challenges.

A recent summit of key nations like China, India, Brazil, Russia, and South Africa—commonly known as BRICS—has brought added urgency to Trump's plan. These countries have been exploring ways to move away from the dollar, which still accounts for nearly 59% of official foreign exchange reserves as of early 2024. Despite a slow decline in its dominance, the dollar remains the world’s most used currency for international trade.

Shifting Global Currency Dynamics

A report from a leading global financial institution highlights that the share of the U.S. dollar in global markets has decreased in some areas, especially in emerging markets. However, increases in dollar-denominated deposits and global debt issuance have offset this decline. Geopolitical trends, including more commodity trading in non-dollar currencies, indicate a gradual shift but do not signal the immediate decline of the dollar's dominance.

The rise of digital currencies and alternative payment systems, such as China’s Central Bank Digital Currency (CBDC) and Russia’s efforts to bypass U.S.-controlled systems like SWIFT, presents further challenges. These trends reflect a global effort to diversify away from reliance on the U.S. dollar, although experts predict that it will take decades for the dollar’s influence to significantly erode.

BRICS and the Push for Dollar Alternatives

Nations within the BRICS bloc are making noticeable strides toward decreasing their dependency on the U.S. dollar. The U.S. dollar has long served as the dominant currency for global trade, commodity pricing, and foreign exchange. However, economic leaders in countries like Brazil and Russia are increasingly pushing for alternatives, including their own currencies and gold reserves. China has also established agreements with countries like Russia and Saudi Arabia to conduct oil transactions in its currency, the renminbi (CNY).

Although there is a strong desire to shift away from the dollar, practical obstacles remain. Structural challenges like China’s need for full currency convertibility and the reluctance of some BRICS countries to give up monetary sovereignty hinder the progress toward a fully unified BRICS currency.

Despite these hurdles, BRICS members continue to develop new financial systems, such as India’s Unified Payments Interface (UPI) and Russia’s SPFS, which seek to offer alternatives to dollar-based trade. The expansion of BRICS, now including countries like Saudi Arabia and the UAE, further accelerates this trend, especially as these nations control a significant portion of the world’s oil production.

Implications for Global Trade and the U.S. Election

Trump’s proposed tariff comes at a critical point in the U.S. presidential race. As he vies for support in key battleground states like Wisconsin, where his economic message resonates with working-class voters, the global economic consequences could be substantial. Countries like India, involved in discussions around de-dollarization, will closely watch these developments.

By focusing on economic nationalism and defending the U.S. dollar’s status, Trump aims to ensure that nations reconsider any moves away from the dollar in global transactions. His aggressive stance on this issue could have far-reaching implications for international trade and relations between the U.S. and its key trading partners.

As the 2024 U.S. election approaches, this issue is likely to remain a major focus of Trump’s campaign, as the global economic landscape continues to evolve.