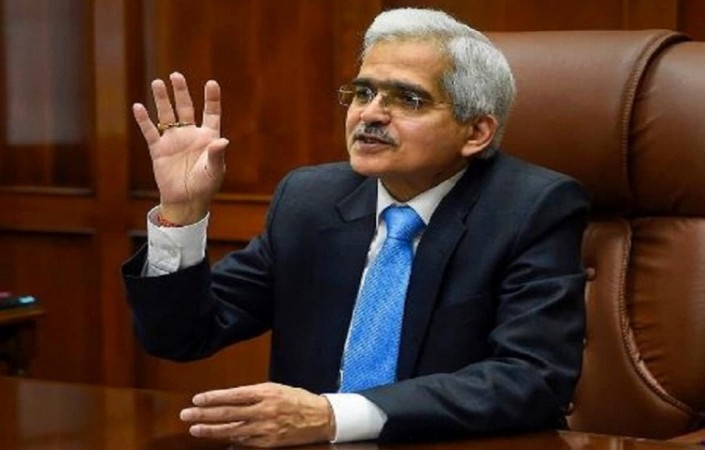

RBI Governor Shaktikanta Das said on Wednesday that the central bank's future policy moves will be driven by changing conditions, following a 0.50 percent hike in the repo rate.

The governor told a press conference that the RBI's policy position has changed, with the phrase "remains accommodative" being replaced with "withdrawal of accommodation" to guide future decisions. Despite the anticipation, the central bank did not raise the cash reserve ratio, he said, adding that the liquidity outflow would be calibrated and measured. He promised that banks will have enough liquidity to lend for economic growth.

The Indian economy is resilient and well-positioned to deal with challenges arising from global concerns, according to Das. This would be aided by a banking system with strong capital buffers, low non-performing assets, and improved provisioning coverage.

The governor expressed confidence that the central bank's initiatives will assist reduce inflation and inflationary expectations among the public at a time when the RBI raised its inflation forecast to 6.7 percent. He stated that the RBI does not intend to make any sudden or harsh actions that might harm inflation and markets.

RBI MPC: Credit cards, starting with RuPay, can be linked to UPI

RBI issues provisioning guidelines for major shadow banks

RBI launches annual survey on foreign liabilities, MF assets, and AMCs