USA: One recurring theme in the statements made by financial leaders over the past few months is their desire to return to their pre-pandemic status.

Things would be fine if we could just return to an inflation rate of 2%, turn back the hands of time to before Russian President Vladimir Putin invaded Ukraine, and convince China to open up and start producing goods for the rest of the world.

It is misguided to long for normalcy. Over-dependence on Russian energy by Europe was a weakness just waiting to be pounced upon. The US Federal Reserve was troubled by low inflation in 2019 because it suggested a fragile labour market. If you believe that things in China are going well in 2019, you likely overlooked the trade war.

Also Read: Armed forces from Mexico are sent to border state after a prison break causes a manhunt

The Beatles' song "Get Back" is fantastic, but it's bad for the economy. Here are five underappreciated geoeconomics trends to keep an eye on as 2023 approaches. With each trend, policymakers have the option of concentrating on a return to the status quo or creating something new and improved this year.

1. The central banks diverge

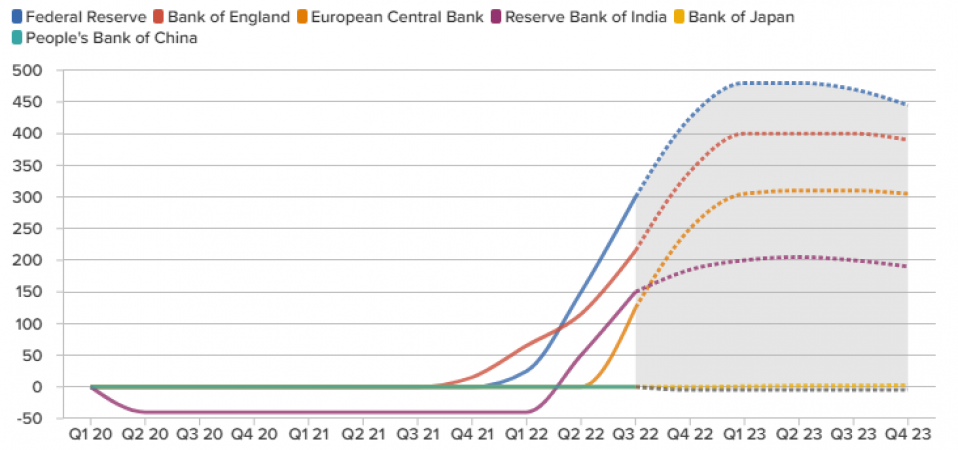

You might believe, based on the last few years, that central banks all operate in unison and adhere to a single theory of inflation and interest rates. However, the updated forecast below will help you understand why everything is about to change.

The biggest central banks in the world have largely acted in unison since the pandemic started. They made rate reductions and rate increases together, and even maintained consistent patterns for the number of basis points raised per meeting.

This year's appearance will be very different. Decisions will be made more widely as local issues in individual economies take precedence over universal factors. Therefore, when Jay Powell, the chairman of the Federal Reserve, finally begins to change course in the coming months, keep in mind the new pattern and don't anticipate that the rest of the world will do the same.

2. Increased pressure on improbable Russian oil consumers

It comes as no surprise that after facing sanctions, Russia has been looking for new oil customers. However, we doubt that most people are aware of how quickly the situation has changed or are aware of precisely which nations have taken action:

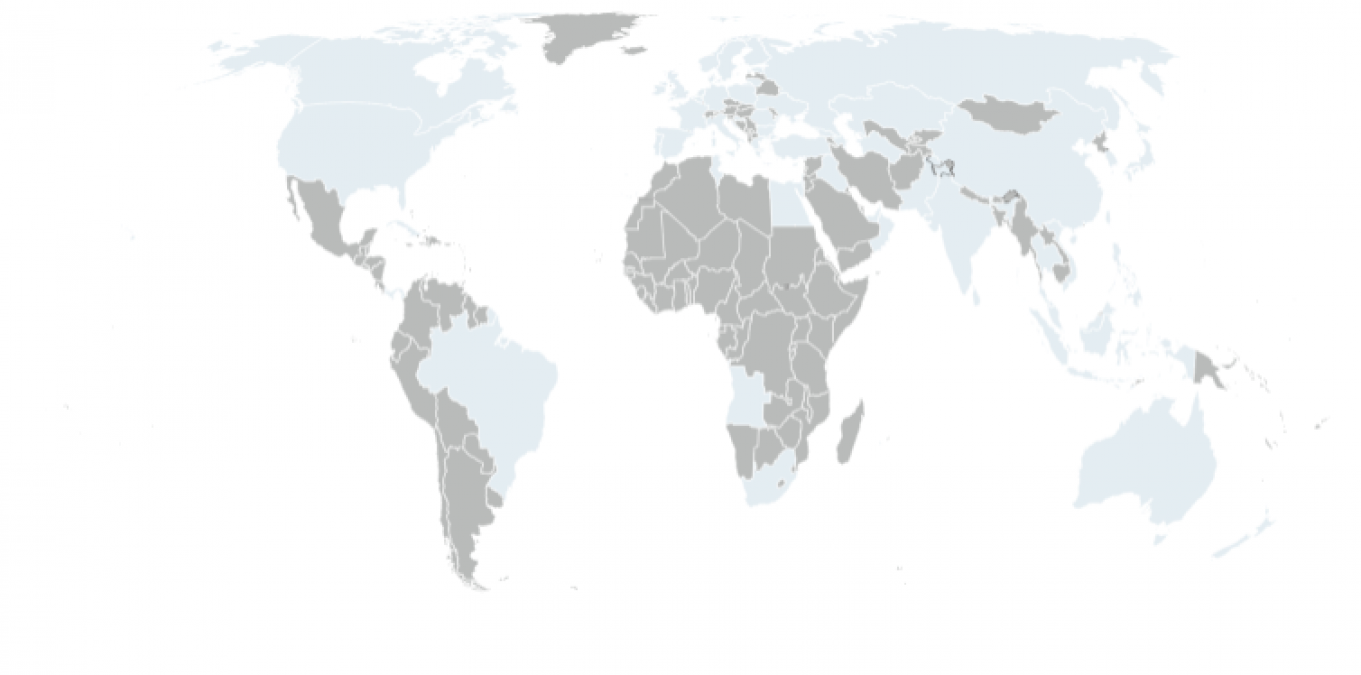

The graph above only shows seaborne imports, so it probably underestimates Beijing's assistance to Moscow. But even so, this chart stands out for India, Kazakhstan, and Egypt. Just Egypt has experienced an increase of 9,983 percent. You did read that correctly.

The graph above only shows seaborne imports, so it probably underestimates Beijing's assistance to Moscow. But even so, this chart stands out for India, Kazakhstan, and Egypt. Just Egypt has experienced an increase of 9,983 percent. You did read that correctly.

Also Read: Oil recovers from an early decline, but China and the global economy cast a shadow over the future

What is going on in Cairo? Egypt appears to be developing into a significant global hub for Russian seaborne oil. Ships are arriving in Egypt, and then the affordable Russian oil is being exported to Saudi Arabia and other countries. We predict that American pressure on the blue nations—particularly nations like Israel and Turkey—increases in 2023.

3. Chinese travellers return to Asia

Over 260 million tourists visited the Asia-Pacific in 2019, and this fueled the creation of nearly 190 million jobs throughout the region. Following the pandemic, China shut down, and international travel is still not fully recovered.

The global tourism industry has been left with a gaping hole as a result of China's lockdown. The effects extend beyond motels and eateries. The money expended by Chinese citizens travelling abroad increased the foreign exchange reserves of other nations.

These Asian countries are currently intervening in their currency markets and are working with decreasing reserves. These governments would be particularly at risk if a wave of defaults occurred or the global recession hit the Asia-Pacific region hard.

There may soon be some relief. Beijing has also announced that its restrictions on international travel will be lifted later this week in response to China's stunning reversal of its domestic COVID controls. But don't anticipate a sudden exodus of Chinese nationals. Some popular tourist destinations, including Japan and South Korea, have implemented new testing requirements for visitors coming from China as a result of the country's rising case numbers. Slower travel recovery due to low consumer confidence, pandemic-related job and savings losses, and other factors. However, the action is a blatant indication that Chinese President Xi Jinping is eager to stress to the region how dependent on China they are.

4. The real economy, not cryptocurrencies is in charge

Over the course of 2022, cryptocurrency lost two trillion dollars, and the outlook for 2023 isn't any better. However, what really worries us is how media attention to and interest in cryptocurrencies stack up against other economic concerns:

Two trillion dollars is obviously a large sum of money. However, the GDP for the entire world is close to $100 trillion. The global semiconductor market, which supports the economic engine of almost every nation in the world, is worth trillions of dollars. But interest in those subjects is far less than that of cryptocurrency.

We comprehend. Similar to a car accident, it can be difficult to look away when something like cryptocurrency is happening because of characters like Sam Bankman-Fried. But anticipate 2023 as the year the real economy exacts its retribution. A global recession will have a much larger impact than FTX ever could, central banks will advance their own digital currencies, and the manufacturing prowess—or lack thereof—of China will determine the financial future of millions of people.

5. G20 voters have limited opportunities to voice their discontent

According to our most recent analysis, 2023 is shaping up to be an oddly quiet year for elections in major economies.

In fact, the Group of Twenty (G20) countries have held so few elections, and the global economy has grown by less than 2 percent only once in the previous fifteen years a good benchmark for a global recession. Only Turkey and Argentina are scheduled to hold national elections in 2023 Turkey has the world's seventeenth-largest economy, while Argentina has long since fallen outside the top twenty. Despite the fact that only one of the two nations has won the World Cup, both have severe inflation issues.

Also Read: IMF:Recession to hit a third of the global economy in 2023

Therefore, citizens won't have the chance to express their discontent during a challenging year for jobs and GDP anywhere in the Group of Seven (G7), barring another early election in a parliamentary democracy. Does that result in unrest or just an increased preparation for 2024? Thought to be the latter, we'll keep a close eye on it nonetheless.