If you've ever applied for a loan, you understand how important your credit report is. However, there are times when inaccuracies in your credit report can reduce your loan eligibility. In such cases, you can file a CIBIL dispute to have the errors corrected as soon as possible.

Here's how to file a credit dispute, also known as a CIBIL.

What Exactly is CIBIL Dispute?

Your credit score is a three-digit number that reflects your creditworthiness. This score is based on your credit history and appears on your credit report. Because your credit report is a summary of your previous loans, as well as your personal and financial information, any discrepancies have an impact on your credit score.

It is best to file a complaint with the CIBIL to resolve the issue. The CIBIL dispute procedure is used to correct any mistakes in your credit report.

You can always correct a mistake in your CIBIL report or score, such as bank-related information, contact information, your name, outstanding balance, date of birth, or loan account date. The process of detecting and correcting inaccuracies in your credit report is known as CIBIL dispute.

Types of CIBIL Disputes:

Individual Disputes may arise as a result of a personal information error or a problem with duplicate accounts. Incorrectly entered names and addresses are examples of personal information errors. A credit inquiry that goes undetected, or a loan that is reflected twice, can result in a duplicate dispute.

Company Dispute- It's possible that there are discrepancies in a company's credit records. It could include issues like incorrect ownership information, data inaccuracies, duplicate accounts, corporate data, and so on. The company's authorized signatory can file a dispute online.

How to Raise a Dispute Online?

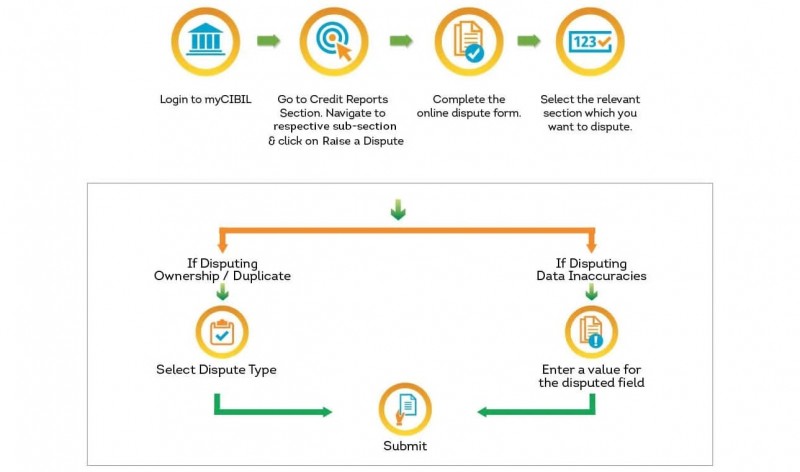

You can travel to different areas of the report and point out inaccuracies in multiple fields within a single dispute. Those looking for a quick solution should use the online method. Follow the steps outlined below to file a dispute online:

Step 1: Log in to myCIBIL with your credentials. You must register with CIBIL and log in to your account if you obtained the report from a vendor.

Step 2: Select the 'Dispute an Item' option from the 'Dispute Center' section of the 'Credit Reports' section.

Step 3: You will be directed to a 'Online Dispute Form.' Complete the form with your details.

Step 4: Under 'Identification #,' select the identity document that needs to be corrected and correct the relevant number at the bottom of the form.

Step 5: Correct information in multiple documents with the '+' symbol.

Step 6: Click 'Submit' after disputing all of the errors.

How to Raise CIBIL Dispute Offline?

You can write to TransUnion CIBIL Limited, One Indiabulls Centre, Tower 2A, 19th Floor, Senapati Bapat Marg, Elphinstone Road, Mumbai – 400 013.

Process of Dispute Resolution

Step 1: The disputed fields will be labeled 'Under Dispute' after you submit the Online Dispute Form.

Step 2: CIBIL will discuss the issue with lenders, depending on the nature of the disagreement.

Step 3: Either the lender accepts or rejects the dispute.

Step 4: If the lender agrees to the dispute, the changes are made.

Step5: Remove the 'Under Dispute' label from the disputed fields.

Step 6: You have 30 days to complete the entire process.

RBI: Banks need to support growth, remain watchful of slippages

ED arrests 1 person from Haryana in 195 cr PMLA case

State Bank of India hikes lending rate by 0.1 pc, EMIs to go up