India is gearing up to appoint new external members to the central bank’s Monetary Policy Committee (MPC) by October, as the team faces mounting pressure to adjust interest rates. This change is expected to occur just before a critical MPC meeting on October 9, where the committee will discuss potential rate cuts.

The selection panel, which includes the Governor of the Reserve Bank of India (RBI) and other key government officials, is set to recommend new candidates within the next two weeks. An official announcement is anticipated by the end of September or early October. The current external members, Jayanth Varma, Ashima Goyal, and Shashanka Bhide, will complete their terms on October 4.

The MPC is composed of six members: three external experts and three RBI officials. The external members, who are typically economists or financial specialists, serve four-year terms. The new appointments are crucial as the current members' terms end just before the next scheduled rate decision.

The selection process must avoid delays similar to those in 2020, when a postponement in appointing external members led to a delay in the MPC's rate meeting, causing policy uncertainty and criticism.

The forthcoming MPC appointments are significant as they coincide with shifts in global central bank policies. The Federal Reserve is expected to cut interest rates as early as September, influencing central banks worldwide. New Zealand and the Philippines have already made rate reductions in response.

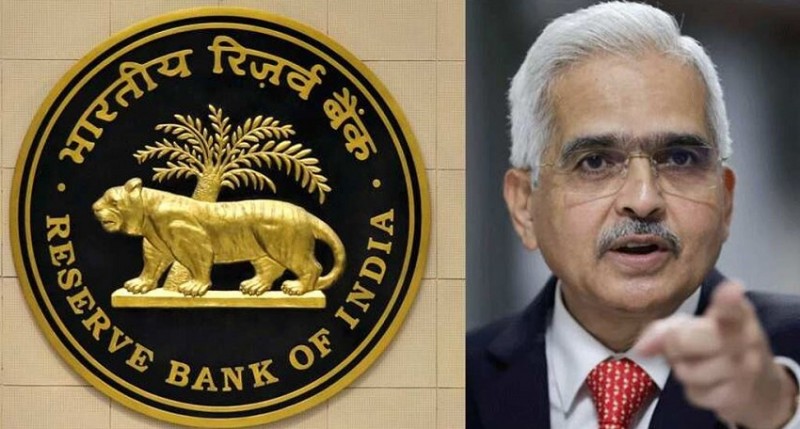

In India, the RBI has kept its benchmark interest rate steady for over 18 months. Governor Shaktikanta Das has been hesitant to ease policy until inflation stabilizes around the RBI’s 4% target. Some current MPC members, including Varma and Goyal, supported rate cuts at the August meeting. Economists generally predict that the RBI will not reduce borrowing costs until late this year, likely following the Federal Reserve's lead.

Additionally, the government is revising its consumer price index, potentially reducing the food sector's influence, which could help mitigate future inflation spikes. The RBI’s inflation targeting framework is also set for review in March 2026, with ongoing discussions about whether food prices should remain part of the target.

RBI Governor Shaktikanta Das Outlines Path to Achieving 'Developed India' Vision by 2047

RBI Governor Shaktikanta Das re-elected as top banker

India's Forex Reserves Drop by $4.8 Billion: Check New Figures Here