CHENNAI: Indian conglomerates can hedge their exposure to gold price risk in international markets on recognised exchanges in the International Financial Services Centre (IFSC), Gujarat, said RBI Governor Shaktikanta Das on Wednesday.

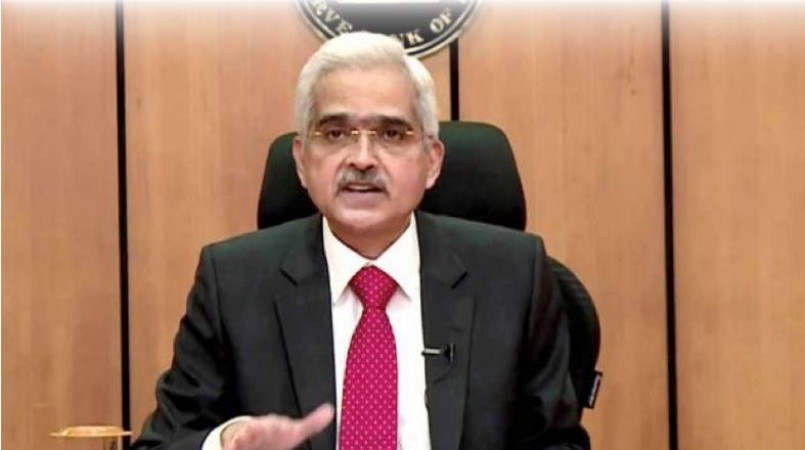

"Resident entities in India are currently not permitted to hedge their exposure to gold price risk in international markets," Das stated in announcing the Monetary Policy Committee's (MPC) decision to raise the repo rate by 35 basis points. "Resident entities will now be able to hedge their gold price risk on recognised exchanges in the IFSC, giving these businesses more flexibility to manage the price risk of their gold exposures. Jewelers and other companies that use gold as a raw material or intermediate product will gain from this action "added Das.

Colin Shah, Managing Director of Kama Jewelry, welcomed the choice and stated: "The RBI's decision to allow gold to be hedged at the IFSC is a wise move that would greatly benefit gold importers and exporters who use yellow metal as their main source of raw materials. This will improve the Indian jewellery industry's ability to compete on price." "The players will be able to better protect their holdings from price swings and unfavourable currency movement.

This will also lead to an increase in volumes and activities at IFSC," Shah added.

Markets turned volatile after RBI hiked repo rate by 35 bps

RBI's big blow to the common public, all loans became expensive