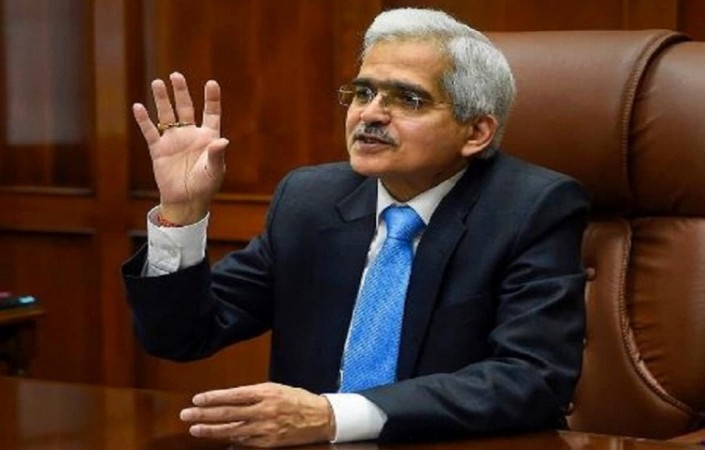

NEW DELHI: Reserve Bank of India Governor Shaktikanta Das said that India's inflation is predicted to gradually decline in the second half of the current fiscal year 2022–2023, "precluding the likelihood of a hard landing" in terms of monetary policy moves. The RBI Governor made the remarks at the ongoing "Kautilya Economic Conclave", organized by the Institute of Economic Growth (IEG).

Retail inflation has now exceeded the Reserve Bank of India's upper tolerance limit of 6 percent for five consecutive months. In addition, domestic wholesale inflation has been in the double digits for more than a year. The RBI's current mandate is to maintain retail inflation at 4% with a tolerance band of 2%, or 200 basis points, on either side.

Das added that between April to June 2021, India was devastated by the second wave of Covid-19, which triggered localised lockdowns, new supply chain disruptions, and growing retail margins. Consequently, between May and June 2021, inflation rose above the 6% mark. Besides negative spillovers from the present increase in commodity prices around the world added to the inflationary pressures, Das said during the event.

The pandemic caused "unprecedented harm to economic activity," he said.. "Real GDP declined by a humongous 23.8 percent in the first quarter of 2020-21 and by as much as 6.6 percent in the full financial year 2020-21," he claimed. In light of this, and despite sporadic inflation above the upper tolerance band of 6%, the monetary policy committee (MPC) of the RBI maintained "status quo" on the key lending rates or repo rate throughout the pandemic.

He supported the current rate policy by claiming that it had seen through the higher inflation reading to allow the fledgling economic recovery to take hold. "Any policy tightening at that time would have been damaging to GDP and imposed large social costs without being helpful in limiting inflation pressures. The inflationary episode lacked any meaningful demand-pull component," he said.

RBI measures lead positive impact on oversesas fund inflows

RBI raises overseas borrowing norms to improve forex inflows

Inflation worries: India's manufacturing PMI hits 9-month low