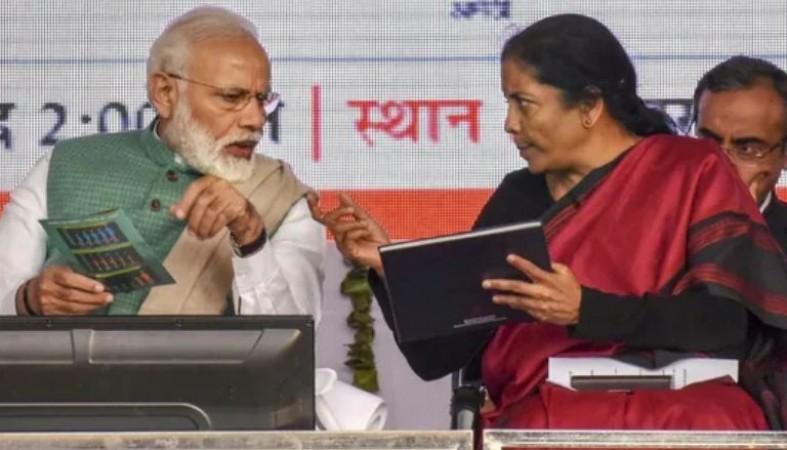

New Delhi: Finance Minister Nirmala Sitharaman, while presenting the Budget on Tuesday, said the budget will serve as a foundation to push economic growth for the coming 25 years with overall and future priorities. The central government will increase spending to Rs 39.45 trillion, or USD 529.7 billion, to build public infrastructure and accelerate economic growth in the coming financial year, but with a wider fiscal deficit than record borrowing. She said thousands of crores would be allocated for expressways, affordable housing and solar manufacturing to boost development.

At the same time, describing the budget as "people-friendly and progressive," PM Modi said it has brought new confidence to development amid one of the most terrible disasters in 100 years, the Corona pandemic. Expressing his views on the Union Budget 2022-23, PM Modi said that this budget will generate many new opportunities for the general public besides strengthening the economy.

What will be cheaper:-

Gemstone stone and diamond

Cloth

Mobile Phone Charger

Camera lenses for cellular mobile phones

Frozen squid

Frozen muscles

Cocoa beans

Asafoetida

Vinegar

Methyl alcohol

Steel waste

Chemicals required for petroleum products

These things will be expensive:-

Fake Jewelry

Single or multiple loudspeakers

Umbrella

Headphones and earphones

Smart Meter

Solar Module

Solar Cells

X-ray Machine

Electronic Parts of Toys

On income tax, Finance Minister Sitharaman on Tuesday announced an opportunity to taxpayers to correct any discrepancy or default in their income tax returns (ITRs) within two years. Currently, if the Income Tax Department finds that some income has been missed, it goes through a lengthy process of judgment. The new proposal will restore confidence in the taxpayer. However, there was no revision in the income tax slab and exemption limit.

At the same time, according to experts, there is no change in this budget regarding individual taxation. But it has added a plan to benefit start-ups and manufacturing units. Earlier, where they had to pay 25 per cent tax, now it has been reduced to 15 per cent. The scheme that benefits these sectors has also been extended by one year. Some major benefits have been included in this Budget. This Budget has taken up the task of enhancing employment and civic amenities in the country.

Some important announcements of the budget-

- It will cost 20 thousand crores to expand the highway. 25,000 km of highway will be built.

- Record will be bought from farmers on MSP. 2.7 lakh crore farmers will be given MSP from procurement.

- Under Make in India, 60 lakh additional jobs will be instituted.

- 5-year programme for MSMEs at a cost of Rs 6,000 crore. Additional assistance of 2 lakh crore.

- 80 lakh new houses under Pradhan Mantri Awas Yojana. 48,000 crore allocation. Under the Har Ghar Tap Scheme, 8.7 crore people will get taps at home. A provision of 60,000 crores for this. 5G will be launched in 2022.

- Digital service will be provided to farmers and agricultural sector startups will be funded by NABARD.

Crude oil prices scales up MCX ahead of the OPEC meeting,

South Korea encounters reduced import curbs in 2021 amid pandemic

35 paise borrowed in 1 rupee of the government, know how much is the share of general public