Equity indices have turned red now with Sensex shedding 150 pts and Nifty fell 53 points at 18,589.75 during mid-session trade IT, Auto, Consumer Durable stocks drag, while FMCG stocks gains.

RBI hikes interest rates by 35 bps to 6.25 percnet with immediate effect. Asian markets are trading lower in the morning.

The Reserve Bank of India's Monetary Policy Committee on Wednesday in a 5:1 decision hiked the repo rate by 35 basis points (bps) to 6.25 percent to contain inflation. The repo rate or policy rate, is the interest at which RBI lends money to the commercial banks.

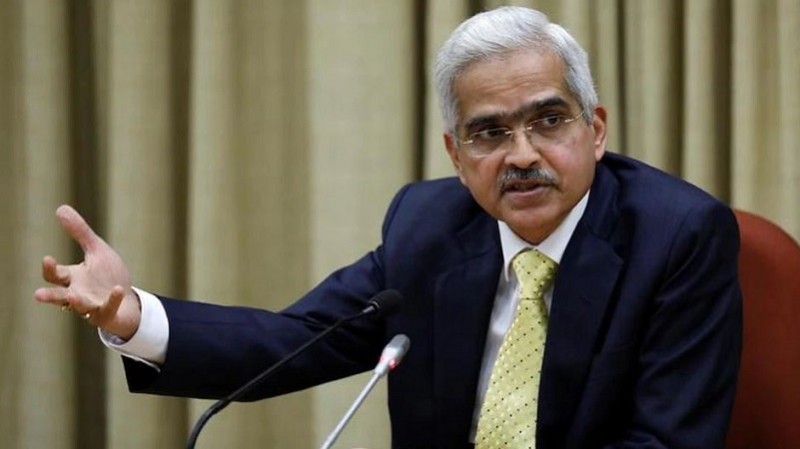

The RBI Governor Shaktikanta Das, heading the MPC, announced the rate hike and added that the battle against inflation was not over. With this the MPC has increased the repo rate by 225 points this fiscal.

The RBI has assessed the gross domestic product (GDP), or economic growth, at 6.8% this fiscal, while placing the headline inflation rate at 6.7%.

RBI Governor said that the Indian economy is robust and inflation is moderate. He added that while the fight against inflation will go on, the issue of economic growth will also be taken into consideration.

When the world was undergoing a severe slowdown, the GDP growth rate of 6.8% remained steady.

The increase in interest rates was in line with what industry authorities and economic analysts had predicted.

RBI MPC Live Updates: Repo rate hiked by 35 bps

RBI's big blow to the common public, all loans became expensive

What to Watch out for from RBI MPC's upcoming meet