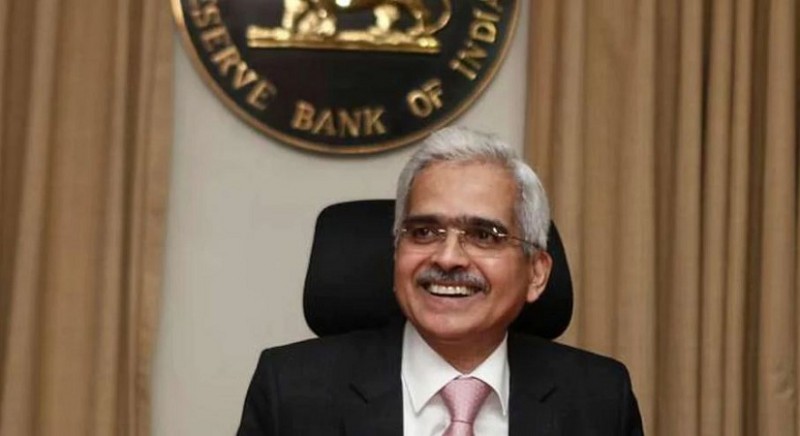

New Delhi: On Friday, Reserve Bank Governor Shaktikanta Das emphasised the importance of central banks having an effective communication strategy, stressing that "monetary policy is an art of managing expectations."

While delivering a lecture at the National Defence College here, he said that the conduct of monetary policy has changed significantly in India and around the world as economies and markets evolved and policymakers gained greater insights into how economic agents interact in a complex economic system.

"Because monetary policy is an art of managing expectations, central banks must constantly strive to shape and anchor market expectations, not just through pronouncements and actions, but also through a constant refinement of their communication strategies to achieve the desired societal outcomes," he said.

While too much communication can mislead the market, too little communication can keep the market wondering about the central bank's policy goal, he noted.

The Reserve Bank of India has used a variety of tools to anchor expectations, including MPC resolutions and minutes, extensive post-policy statements with a statement on developmental and regulatory measures, press conferences, speeches, and other publications, particularly the biannual Monetary Policy Report (MPR), Das said.

According to the governor, price stability is defined numerically by a target of 4% for the headline Consumer Price Index (CPI) with a tolerance margin of +/- 2% around it under the statute. The FIT (flexible-inflation-targeting) regime's flexibility stems from provisions to absorb or see-through transient supply-side inflation shocks.

License of this bank has been cancelled, depositors will get 5 lakh rupees!

Reserve Bank to support growth as inflation seen easing: Minutes