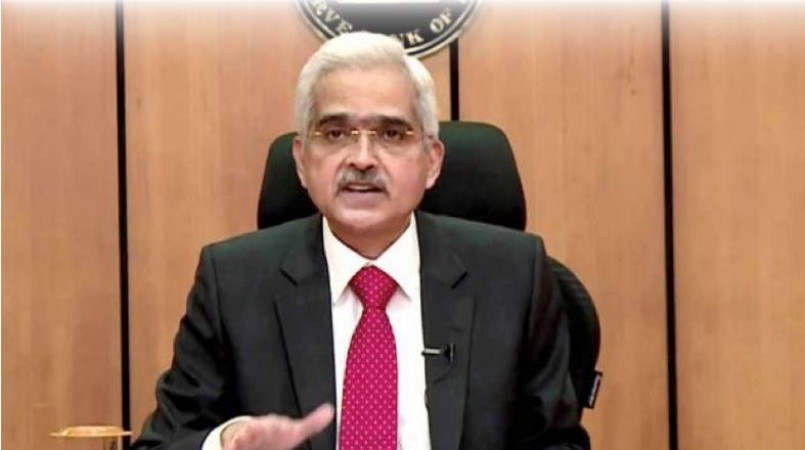

NEW DELHI: With retail inflation showing signs of softening and the US Federal Reserve moderating the pace of increase in its benchmark interest rate, the Reserve Bank is likely to settle for a smaller 25 basis points (bps) repo rate hike

In its upcoming bi-monthly monetary policy meeting due later this week. In its December monetary policy review, the RBI had raised the key benchmark interest rate by 35 basis points after delivering three back-to-back increases of 50 bps. Since May last year, the RBI has increased the the short-term lending rate by 225bps to contain inflation, mostly driven byexternal factors, especially global supply chain disruption following the Russian outbreak. RBI's rate-setting panel - Monetary Policy Committee (MPC) - will start its 3-day deliberations today, February 6 and the decision will be announced on February 8.

Kotak Institutional Equities in a report said the global inflation environment is gradually turning benign although inflation is still well above every central bank's target. Inflation will likely moderate further in the next few months, leading to the end of the rate hiking cycle by the firsthalf of 2023 and possible rate cuts in late 2023 early-2024. "We expect the RBI MPC to hike policy rate by 25 bps to 6 percent, after by a prolonged wait-and-watch approach, as it assesses the lagged impact of monetary tightening on growth and inflation," the report read.

This Bank implements RBI's first phase of Digital Rupee, Know more

Digital creator and actor Surbhi Rathore celebrates Christmas in Dubai

Centre hopes dividend of Rs48,000 cr from RBI, PSU banks in FY24