The RBI is expected to keep rates unchanged and maintain its accommodative stance in its first MPC meet for the new financial year.

On April 6, the Reserve Bank of India's rate-setting panel began deliberations to finalise the next bi-monthly monetary policy, amid predictions that it will keep the interest rate unchanged but shift its monetary policy stance in response to rising inflation due to geopolitical developments.

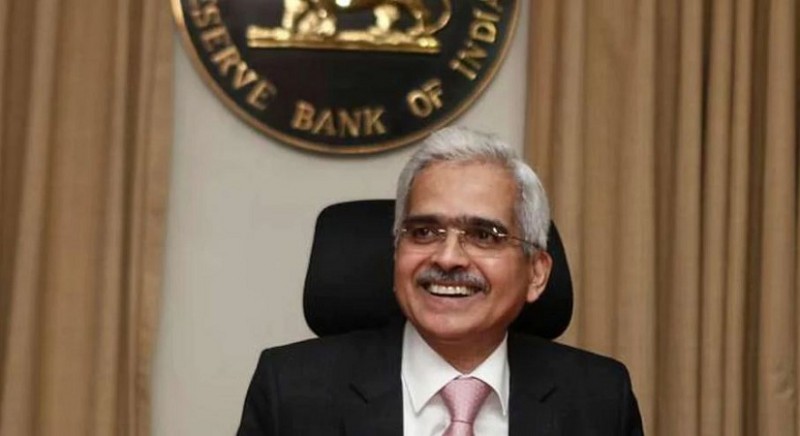

The Monetary Policy Committee (MPC), headed by Reserve Bank Governor Shaktikanta Das, is held its first meeting in the current FY from April 6 to 8 and the result will be declared at 10 am today (April 8).

The MPC has kept the interest rate steady and maintained an accommodating monetary policy stance in the last ten meetings. On May 22, 2020, the repo rate, or short-term lending rate, was last reduced. Since then, the rate has remained at an all-time low of 4%. To boost the economy in the face of economic consequences from the epidemic, the central bank has dropped its primary lending rate, or repo rate, by 115 basis points since March 2020.

In an off-policy cycle when COVID-19 provided an unprecedented challenge to the economy, the RBI last reduced its policy rate on May 22, 2020. Since then, the central bank has kept the repo rate, which is the interest rate at which the RBI loans money to commercial banks, at a 19-year low of 4%. The reverse repo rate is 3.35 percent, which is the rate at which the RBI borrows from banks.

RBI's MPC begins discussions on next bi-monthly policy

RBI likely to go for cumulative rate rise of 125bps in FY 2023: Morgan Stanley