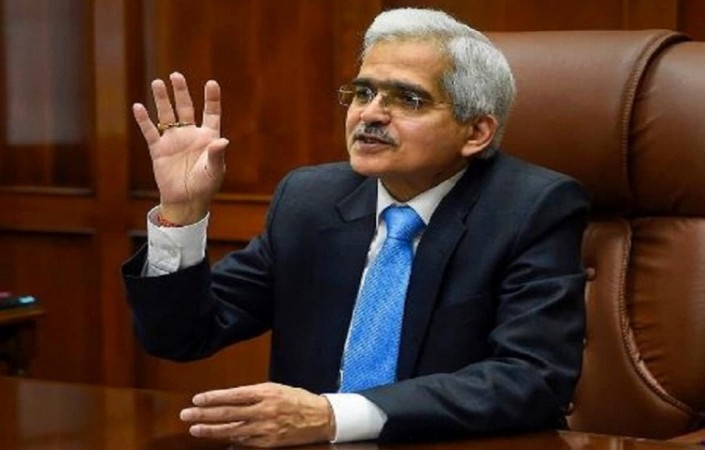

Shaktikanta Das, governor of the Reserve Bank of India (RBI), will announce the outcome of the MPC meeting on Thursday. On Tuesday, the six-person RBI MPC meeting got underway. The RBI is expected to maintain the benchmark interest rate at 6.5 percent during the MPC meeting in order to reduce retail inflation and promote economic growth.

After the most recent MPC meeting in April, the RBI decided to halt its rate-hike cycle. The 6.5% repo rate has been maintained by the central bank. In order to combat inflation prior to this, the Central Bank raised the repo rate by 250 bps since May 2022.

In the meantime, the Consumer Price Index (CPI) fell to an 18-month low of 4.7% in April of this year. Shaktikanta Das predicted that May's figures will be lower than those for April. On June 12, the CPI figures for May are expected to be released. The RBI has been instructed by the government to maintain CPI inflation at 4% with a 2% tolerance on either side. View the most recent Business Today updates.Will the RBI decrease the repo rate?

Here are the predictions made by SBI for today's RBI MPC results.

SBI report The largest public lender in India, State Bank of India (SBI), recently stated its belief that the repo rate would remain steady while adding that the central bank may cut its projections for FY24 inflation. The RBI was also quoted in the article, stating that the rate freeze was a "temporary arrangement".

"With sizeable banking failures across AEs, and a fair probability of contagion spreading across markets despite concerted action from policy makers/regulators to check the same, RBI's endeavour to sidestep from synchronous rate hike was a courageous gambit, especially since climate risk could upend inflationary projections," the SBI report stated.

Ahead of RBI Monetary Policy, Rupee opens 4-ps lower at 82.59 against USD