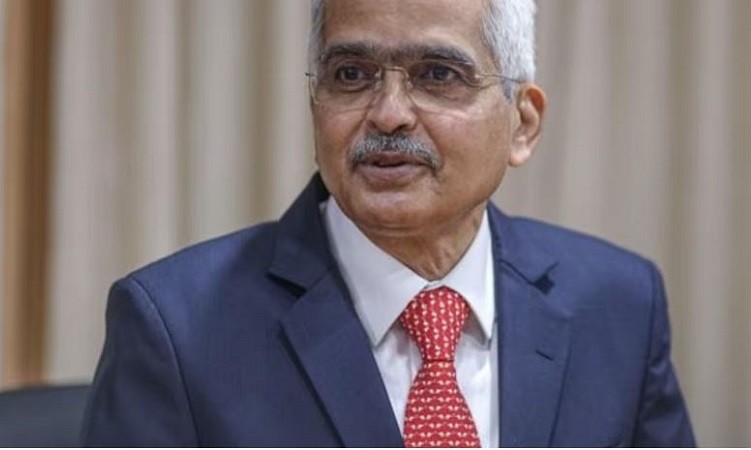

In an effort to bolster the system for addressing customer grievances, RBI Governor Shaktikanta Das announced on October 6th that the Central bank has made significant changes. These changes include consolidating and harmonizing the Internal Ombudsman guidelines into a comprehensive master direction.

Shaktikanta Das emphasized that these measures would fortify the customer grievance redressal system for regulated entities, as he unveiled the bi-monthly monetary policy.

The Reserve Bank of India initially introduced the Internal Ombudsman (IO) mechanism in select scheduled commercial banks back in 2015. The primary goal was to reinforce their Internal Grievance Redress (IGR) system, ensuring efficient and equitable resolution of customer complaints. This was achieved by establishing an apex-level review process within the banks before the rejection of such complaints.

Over time, the framework has expanded to include other regulated entities (REs), such as select Non-Bank System Participants (non-bank issuers of PPIs), select Non-Banking Financial Companies, and all Credit Information Companies.

The current IO framework guidelines, which apply to various categories of REs, share common design features but vary in operational aspects. Shaktikanta Shaktikanta Das noted, "Drawing from the experience gained through the implementation of these existing IO guidelines, it has been decided to streamline and issue a consolidated master direction."

"The master direction will introduce uniformity in areas such as the timeline for escalating complaints to IOs, exclusions, temporary absence of the Internal Ombudsman, minimum qualifications for appointing an Internal Ombudsman, and updates to reporting formats. It will also introduce the position of Deputy Internal Ombudsman," he added.

Also Read: RBI Incorporates PM Vishwakarma in PIDF Scheme; Extends Scheme's Duration by Two Years

Recognizing the potential role of Self-Regulatory Organizations (SROs) in promoting a culture of compliance among their members and providing a consultative platform for policymaking, Shaktikanta Shaktikanta Das announced, "We have decided to introduce a comprehensive framework for recognizing SROs across various sectors regulated by the Reserve Bank."

"The omnibus SRO framework will outline broad objectives, functions, eligibility criteria, governance standards, and more, which will apply universally to all SROs, regardless of the sector they operate in," he stated.

Shaktikanta Das added, "The Reserve Bank may specify sector-specific additional requirements when inviting applications for SRO recognition. Initially, a draft of the omnibus framework will be released for feedback from stakeholders."

RBI Monetary Policy LIVE: Repo Rate Holds Steady at 6.5%, See Updates