The Reserve Bank of India (RBI) is expected to maintain a status quo on key rates in its bi-monthly policy review to be announced as Omicron, a new strain of Coronavirus, adds to the economic uncertainties.

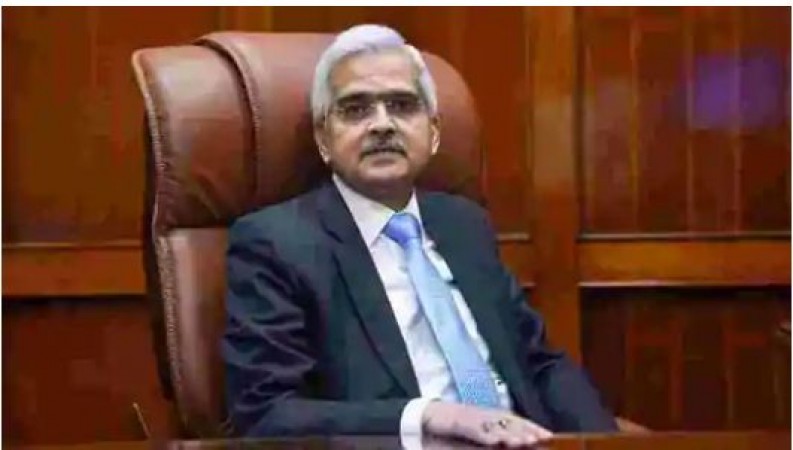

In the last policy review in October, the Reserve Bank had kept the key lending rates unchanged for eight consecutive times. The repo rate, at which the RBI lends short-term funds to banks, was kept unchanged at 4 percent. The reverse repo rate, at which the Central bank borrows from banks, was kept unchanged at 3.35 percent. The Marginal Standing Facility (MSF) rate was also kept unchanged at 4.25 percent. After the Monetary Policy Committee (MPC) meeting on October 8, RBI Governor Shaktikanta Das had announced that the Reserve Bank would maintain an "accommodative" stance on policy rates and would ensure that inflation remains within the target range.

An accommodative stance refers to the willingness to either cut rates or maintain the status quo. The last time the Reserve Bank changed the policy rate was in May 2020. The RBI bank had slashed the key policy rates in May 2020 to historic lows to support the economy hit by the Covid-19 pandemic.

MPC Meet of the RBI begins with hope of maintaining the status quo

RBI is poised to keep rates unchanged over new Covid variant

RBI, crypto industry bodies mulls steps to regulate, track crypto trading