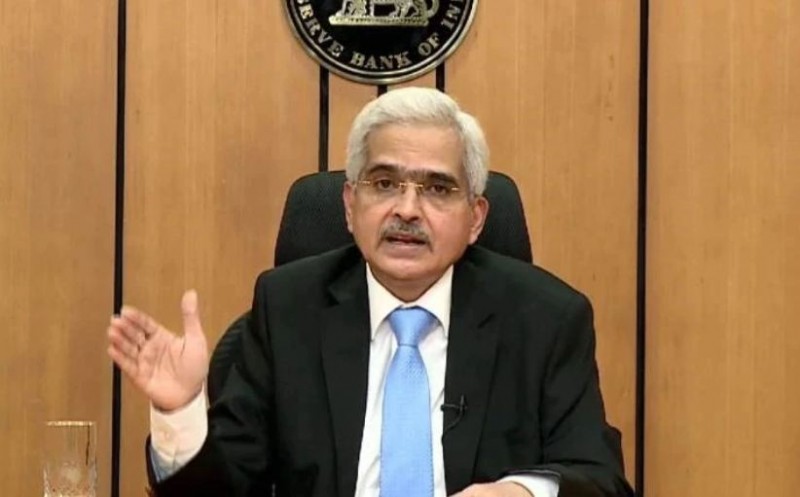

New Delhi: The meeting of the Monetary Policy Committee of the Reserve Bank of India (RBI) has started. Tomorrow (April 7, 2021), the RBI will announce the monetary policy. In such a situation, the question is being raised that what will be decided in the meeting regarding interest rates. Will the loan rates be cut or will the interest rates rise. What steps will the RBI take to keep the quasi-system engulfed by the second wave of the Corona transition?

The question is also that what will be the decision in the meeting regarding the rising rates of inflation. What will be the trend of RBI if foreign investors turn towards the Indian market due to an increase in yield on US bonds. All these issues are expected to be discussed in tomorrow's meeting. It is being told that the rate at which inflation has gained momentum, it seems that it will not cut interest rates.

Fuel inflation has reached 5.36 percent and core inflation has reached 5.36 percent. In such a situation, he would not want to risk cutting interest rates. Increasing growth will be a priority for RBI. Even after this, interest rates are not expected to be cut. Presently, the repo rate is four and the reverse repo rate is 3.35 percent. The CRR has been increased from three percent to 3.5 percent with effect from 27 March 2021. At the same time, CRR will increase to four percent from 22 May 2021.

Also Read:

CID sub-inspectors body found in hotel room, police engaged in investigation

Good news farmers, CM KCR releases water into Haldi Vage from Sangareddy canal