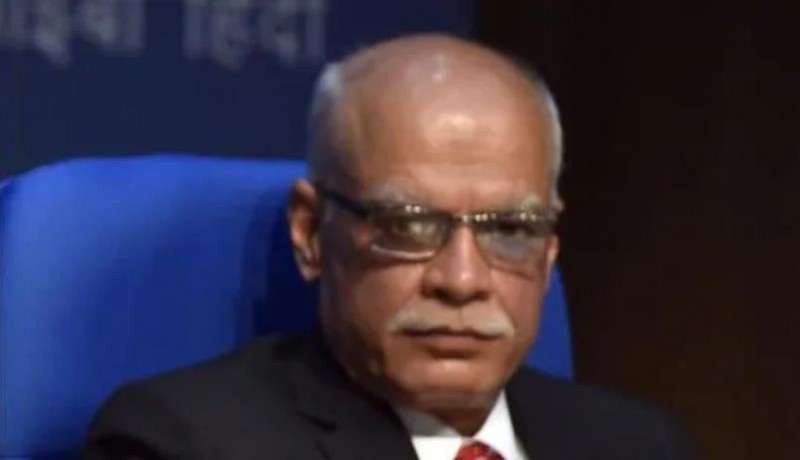

New Delhi: The Supreme Court's decision on the applicability of the GST Council's decisions is unlikely to have a significant impact on the one-nation-one-tax regime because it is simply a reiteration of the existing law, which gives states the power to accept or reject the panel's taxation recommendations , i.e, a power that no state has exercised in the last five years, said Revenue Secretary Tarun Bajaj.

The Constitutional amendment that brought the Goods and Services Tax (GST) regime into effect in July 2017 by combining almost a half-dozen federal and state taxes established a Council of Centre and States to make decisions. According to the Constitutional amendment, the GST Council's suggestions were always intended to be advisory rather than forced compliance, sai Bajaj.

States never went back and formulated legislation that was not in line with the panel's recommendations, even if they disagreed on tax rates on a specific commodity or service in the Council.

And the official predicted that this behaviour will continue unabated after the Supreme Court declared in the Mohit Minerals Ocean Freight case that the GST Council's recommendations are not binding and simply had persuasive value. It was decided that both the federal and state legislatures can legislate on GST.

"The GST statute states it will recommend, but it says nothing about mandating." It is a constitutional body, an executive body constituted by the constitution that consists of the federal government and state governments, that will make recommendations, and we have built our GST laws on their recommendations. This is how things work," Bajaj added.

Centre releases Revenue deficit grant of Rs 7,183.42 crore to 14 States

Central Bank of India returns to black with Rs 310 cr net profit in March qCasinos, online gaming, race course to attract 28pc GST soonuarter