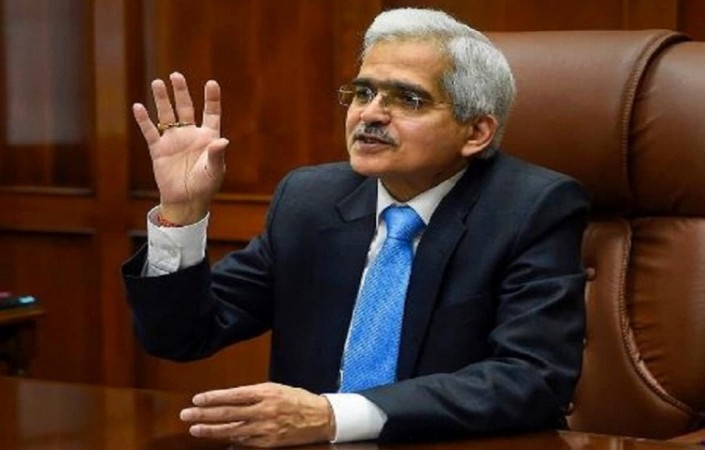

The scrapping of Rs.2,000 banknotes is a key step in currency management, said the Reserve Bank of India (RBI) Governor Shaktikanta Das.

The Reserve bank of India Governor is attending RBI's internal event on ‘Leadership and Governance in Banks: Driving Sustainable Growth and Stability’.

The RBI made the announcement that it would stop printing notes with a value of Rs. 2,000 on Friday and instructed banks to stop doing so right once. However, until September 30, 2023, the public may deposit or exchange these notes at banks and they will continue to be considered legal cash.

On May 22, the Reserve Bank of India (RBI) sent banks a notice informing them that the public would be able to exchange Rs. 2,000 banknotes over the counter in the same way as before.

In light of the summertime, the central bank recommended banks to set up appropriate infrastructure at their branches, including shaded waiting areas and water fountains.

According to the statement, banks must keep daily records of deposits and exchanges of Rs. 2,000 banknotes in a format given by the RBI and report them as needed.

The RBI unexpectedly announced on Friday that it would withdrawing all Rs. 2,000 notes from circulation, although it offered the people until September 30 to deposit the notes in accounts or swap them at banks.

As the RBI moves to increase deposits, bonds in India could rise

Congress targets PM Modi over withdrawal of Rs. 2,000 notes

Rs2,000 notes withdrawal: What the Ex-Chief Economic Advisor says