Ruchi Soya Industries, a Patanjali Group company, has set a price range of Rs 615 to Rs 650 per share for its follow-on public offering, which will begin on March 24. The sale consists of a new issuance of equity shares for a total of Rs 4,300 crore.

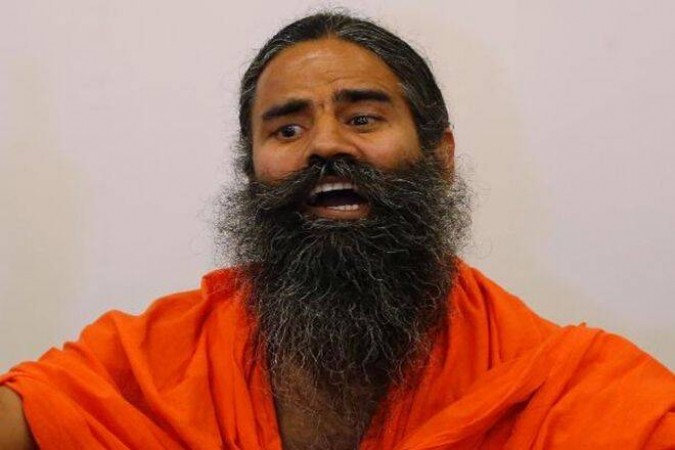

The company intends to use the offer funds primarily to pay down debt and then for general corporate reasons. The corporation currently owes Rs 3,300 crore in debt.The company, which was acquired by Baba Ramdev's Patanjali Group via the National Company Law Tribunal (NCLT), is one of the country's largest branded oil packaged food companies, with brands such as Ruchi Gold, Mahakosh, Sunrich, Ruchi Star, and Ruchi Sunlight, as well as soya foods under the 'Nutrela' brand. While announcing the FPO to the media, Baba Ramdev stated that the goal is to make the Indian company a global brand.

"Ruchi Soya is no longer merely a commodity firm." "Among other verticals, it has FMCG, food business, and nutraceutical," Ramdev said, adding that the company would focus on rural distribution in India while also expanding its global reach."We will speak to both the people and the classes," he stated.The investment bankers in charge of the issuance are SBI Capital Markets, Axis Capital, and ICICI Securities.The bidding for the follow-up public offer will close on March 28.

Govt may postpone the LIC IPO until fiscal 2023

Finance Ministry inform Lok Sabha, Govt proposed to sell 5pc stake in LIC via IPO

Reserve Bank likely to prioritise growth during April meeting