In today's society, financial success and independence are highly sought-after. Many people dream of becoming wealthy and creating a better life for themselves and their families. However, not everyone possesses the knowledge and mindset required to achieve financial prosperity. "Rich Dad and Poor Dad" is a concept that highlights the contrasting approaches to wealth and financial education. In this article, we will explore the principles behind this concept and understand the key differences between the mindset of a rich dad and a poor dad.

The Importance of Financial Education: One of the fundamental differences between a rich dad and a poor dad lies in their approach to financial education. A rich dad understands the importance of continuously learning about money, investing, and personal finance. They recognize that financial education is not typically taught in schools and take it upon themselves to acquire the necessary knowledge. In contrast, a poor dad may lack financial literacy and rely solely on traditional employment to generate income.

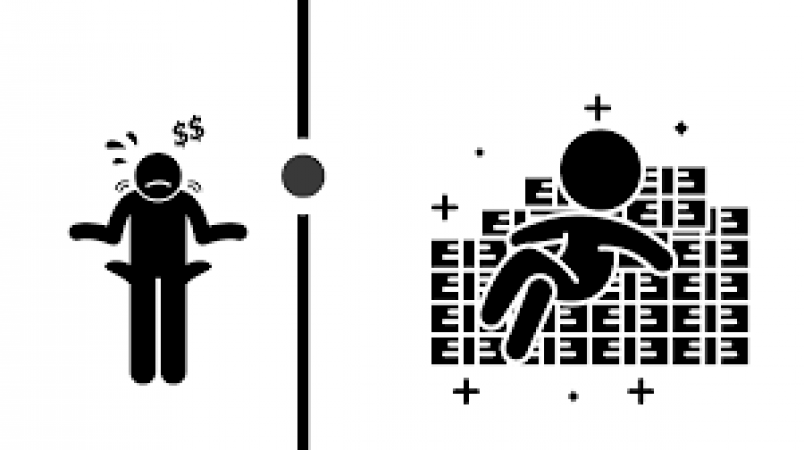

The Mindset of a Rich Dad: A rich dad possesses a mindset that is focused on wealth creation and financial independence. They prioritize building assets that generate income and appreciate in value over time. A rich dad understands that money should work for them, and they actively seek out investment opportunities to grow their wealth. They are not afraid to take calculated risks and are always looking for ways to increase their passive income streams.

The Mindset of a Poor Dad: On the other hand, a poor dad tends to have a scarcity mindset. They may be trapped in a cycle of living paycheck to paycheck, accumulating liabilities, and struggling to make ends meet. A poor dad often relies heavily on a single source of income, such as a job, without considering alternative ways to generate wealth. They may have a fear of taking risks and prefer to play it safe, even if it means missing out on potential opportunities for financial growth.

Building Assets vs. Accumulating Liabilities: A crucial aspect of the rich dad mindset is the understanding of building assets versus accumulating liabilities. An asset is something that puts money in your pocket, such as real estate, stocks, or a business. A liability, on the other hand, takes money out of your pocket, such as credit card debt or a car loan. A rich dad focuses on acquiring assets that appreciate in value and generate passive income, while a poor dad may spend his money on liabilities that do not contribute to long-term wealth creation.

The Role of Investments: Investments play a vital role in the journey to financial success. A rich dad actively seeks out investment opportunities and understands the power of compound interest. They diversify their investment portfolio and leverage the expertise of financial advisors to make informed decisions. A poor dad may shy away from investments due to a lack of knowledge or a fear of losing money. As a result, they miss out on the potential benefits and growth opportunities that investments can provide.

The Power of Passive Income: One of the key principles embraced by a rich dad is the concept of passive income. Passive income is money earned with minimal effort or active involvement. It provides financial freedom and allows individuals to pursue their passions and interests rather than being tied down to a traditional job. A rich dad focuses on creating multiple streams of passive income, such as rental properties, royalties, or dividend-paying investments. This approach provides them with financial stability and the flexibility to enjoy life on their terms.

Creating a Wealthy Legacy: A rich dad not only strives for personal wealth but also aims to create a wealthy legacy for future generations. They understand the importance of passing on financial knowledge and principles to their children and loved ones. By instilling a rich dad mindset in the next generation, they ensure that their family members have the tools and mindset necessary to build and sustain wealth over time.

Overcoming Fear and Taking Risks: Taking calculated risks is an essential aspect of wealth creation. A rich dad understands that fear can hold individuals back from pursuing opportunities that could potentially lead to financial success. They are willing to step outside their comfort zones, embrace uncertainty, and learn from their failures. By overcoming fear and taking calculated risks, a rich dad opens doors to new possibilities and experiences exponential growth.

The Value of Learning from Mistakes: Mistakes are inevitable on the path to success, and a rich dad recognizes their value as learning opportunities. Rather than dwelling on failures, they view them as stepping stones towards growth and improvement. A rich dad analyzes their mistakes, adjusts their strategies, and perseveres with determination. In contrast, a poor dad may be discouraged by failures and may not fully capitalize on the lessons they offer.

The Impact of Financial Literacy: Financial literacy plays a significant role in shaping an individual's financial journey. A rich dad understands that knowledge is power, and financial education is the key to making informed decisions. They actively seek resources, attend seminars, read books, and network with like-minded individuals to expand their financial knowledge. A poor dad may not prioritize financial literacy and may miss out on opportunities due to a lack of understanding or awareness.

Teaching Financial Education to the Next Generation: Breaking the cycle of financial struggle involves equipping the next generation with the tools they need to succeed. A rich dad emphasizes the importance of financial education and teaches their children about money, investing, and financial independence from an early age. By providing them with a solid foundation of financial literacy, a rich dad empowers their children to make wise financial choices and build their wealth.

Achieving Financial Independence: Financial independence is a goal shared by many individuals. It refers to the ability to sustain one's desired lifestyle without relying on traditional employment or a single source of income. A rich dad strives for financial independence by building a robust portfolio of assets that generate passive income. They have the freedom to make choices based on their passions and interests rather than financial obligations.

The Journey to Wealth: The journey to wealth is not a sprint but a marathon. It requires dedication, discipline, and a long-term perspective. A rich dad understands that wealth accumulation takes time and patience. They are willing to invest in themselves, embrace lifelong learning, and make strategic decisions to grow their wealth over time. By adopting a rich dad mindset and following a well-thought-out plan, individuals can embark on their own journey to financial prosperity.

Conclusion: In conclusion, the concept of "Rich Dad and Poor Dad" highlights the contrasting approaches to wealth and financial education. A rich dad possesses a mindset focused on financial literacy, wealth creation, and building assets that generate passive income. They embrace calculated risks, overcome fear, and view mistakes as valuable learning experiences. In contrast, a poor dad may lack financial education and be trapped in a cycle of financial struggle. By understanding the principles behind the rich dad mindset and taking steps to improve financial literacy, individuals can pave their own path to financial independence and create a better future for themselves and their families.

The Theremin: Unlocking the Mysteries of the Touchless Electronic Musical Instrument

Sony Launches WF-C700N Truly Wireless Earbuds in India

Dual Smartphone Usage: A Potential Tool for Achieving Work-Life Balance