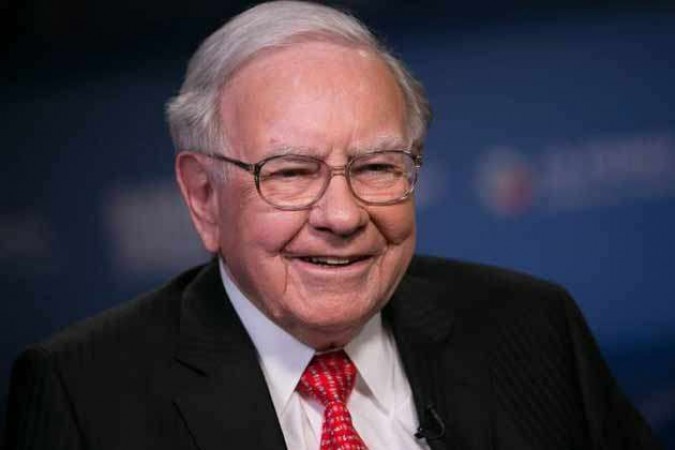

Warren Buffett, one of the world's most successful investors, said on Saturday that Berkshire Hathaway is ready for his departure. He also announced the exit of his 96-year-old partner Charlie Munger (96) soon. Buffett, who made his first investment at the age of just 11, built a large empire with his understanding and experience. Erected, which he will soon leave. While famous for his philanthropic works and known as 'Oracle of Omaha', Buffett has been on the list of world's richest people for many years, yet his humble behavior wins the hearts of people.

Coronavirus Impact: Many Chinese companies are facing losses, economic activity come to standstill

Buffett, 89, stated in his annual letter to shareholders that Berkshire's shareholders need not be upset as the company is fully prepared to bid farewell to both. At the moment, nobody talked about his own successor. For the time being, in May last year, at the annual meeting of shareholders, he had indicated that Greg Able or Ajit Jain of Indian origin could take over the reins of the company in the future. This annual letter of Warren is eagerly awaited by his fans and investors from all over the world. In this, he is open-minded on Berkshire, the economy, investment, and other issues. Born in Odisha, Jain did BTech from IIT Kharagpur.

These banks gives upto 9% interest on fixed deposit, Know complete interest rate

He then worked at IBM. For the time being, he moved to the US to pursue an MBA. He joined Berkshire Hathaway's insurance business in 1986. At that time he had very limited knowledge about insurance. However, he quickly learned the business and his contribution to boosting Berkshire earnings has been significant. Buffett's Berkshire Hathaway has earned a record $ 81.42 billion. The company's common stock holdings were a major gainer. At present, operating profit has fallen by three percent. Warren is defending the company's decisions to invest heavily in shares of companies like Apple. Berkshire was trying to buy some companies, but the deals could not be finalized.