If you've ever applied for a loan, a credit card, or even rented an apartment, you've probably heard the term "FICO score" being thrown around. But what exactly is a FICO score, and how does it impact your financial life? In this comprehensive guide, we'll delve into the world of FICO scores, understand how they are calculated, and explore their significance in credit evaluation.

What is a FICO Score?

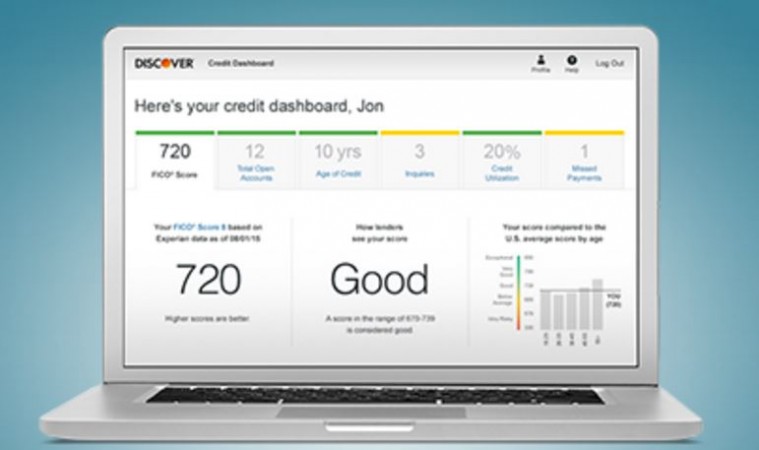

A FICO score, named after the Fair Isaac Corporation that developed it, is a three-digit number that reflects your creditworthiness. It is a standardized measure used by lenders to assess the risk of lending money or extending credit to an individual. FICO scores range from 300 to 850, with higher scores indicating a lower credit risk.

Why is a FICO Score Important?

Your FICO score plays a crucial role in various financial decisions, influencing the interest rates you receive on loans and credit cards, determining whether you qualify for a mortgage, and even impacting your ability to rent an apartment. A higher FICO score can lead to better financial opportunities and potentially save you thousands of dollars in interest over time.

Components of a FICO Score

Payment History

Your payment history is the most significant factor in calculating your FICO score. It accounts for approximately 35% of the overall score and reflects whether you've made payments on time, missed any payments, or defaulted on loans.

Credit Utilization

Credit utilization refers to the ratio of your credit card balances to your credit limits. This component constitutes about 30% of your FICO score. Keeping your credit utilization low demonstrates responsible credit management and can positively impact your score.

Length of Credit History

The length of your credit history contributes around 15% to your FICO score. It considers how long your credit accounts have been active, including the age of your oldest account, the average age of all accounts, and the age of your newest account.

Types of Credit in Use

This component evaluates the variety of credit accounts you have, such as credit cards, mortgages, and installment loans. It constitutes about 10% of your FICO score. A diverse mix of credit can demonstrate your ability to manage different types of credit responsibly.

New Credit

Opening multiple new credit accounts in a short period can negatively impact your FICO score, as it may suggest financial instability. This component makes up about 10% of your score and considers factors like the number of recently opened accounts and the number of recent inquiries.

The FICO Scoring Range

FICO scores are categorized into different ranges, each indicating a specific level of creditworthiness:

Excellent Credit (750-850)

Individuals with excellent credit scores have a strong history of responsible credit management. They are likely to qualify for the best interest rates and loan terms.

Good Credit (670-749)

Good credit indicates a solid credit history and demonstrates reliable payment behavior. While not at the highest level, individuals with good credit scores can still access favorable terms.

Fair Credit (580-669)

Fair credit suggests a decent credit history, but there might be some negative marks or limited credit experience. Interest rates may be higher, and loan approvals could be subject to more scrutiny.

Poor Credit (300-579)

Individuals with poor credit may have a history of missed payments, defaults, or bankruptcies. They may face challenges in obtaining credit and may need to work on rebuilding their credit.

Factors That Do Not Affect Your FICO Score

Contrary to popular belief, several factors do not influence your FICO score:

Race, Gender, and Nationality

FICO scores are solely based on credit-related information. Factors like race, gender, and nationality have no bearing on your score.

Income and Employment Status

While your income and employment status can affect your ability to repay loans, they are not directly considered in FICO score calculations.

Soft Inquiries

When you check your own credit report or when a lender pre-approves you for an offer, it results in a soft inquiry that does not impact your FICO score.

How FICO Scores are Calculated

Calculating a FICO score involves considering various factors with different weights:

The Weight of Each Component

Each component of your credit history is assigned a specific weight, with payment history and credit utilization carrying the most significant influence.

Impact of Late Payments and Defaults

Late payments and defaults can significantly lower your FICO score, highlighting the importance of consistently paying bills on time.

Role of Credit Utilization

Maintaining a low credit utilization ratio indicates responsible credit management and can positively affect your FICO score.

Tips to Improve Your FICO Score

Improving your FICO score requires a proactive approach to credit management:

Pay Your Bills on Time

Consistently paying your bills on time is one of the most effective ways to boost your FICO score over time.

Reduce Credit Card Balances

Lowering your credit card balances can improve your credit utilization ratio and positively impact your FICO score.

Maintain a Diverse Credit Mix

Having a mix of different credit types, such as credit cards, installment loans, and mortgages, can demonstrate your ability to manage various financial responsibilities.

Think Twice Before Closing Accounts

Closing credit accounts can impact your credit utilization ratio and potentially lower your FICO score. Think carefully before closing accounts, especially the ones with a long credit history.

Regularly Check Your Credit Report

Monitoring your credit report allows you to identify and address errors or fraudulent activities that could negatively affect your FICO score.

The Role of FICO Scores in Credit Evaluation

Lenders heavily rely on FICO scores to make informed lending decisions:

Lenders and FICO Scores

Lenders use your FICO score to assess the risk of lending you money. A higher score may result in better loan terms, while a lower score could lead to higher interest rates or loan denials.

Interest Rates and Loan Approvals

A higher FICO score can translate to lower interest rates, potentially saving you a substantial amount of money over the life of a loan. Moreover, it increases your chances of being approved for credit.

In the realm of personal finance, understanding your FICO score is crucial. It serves as a gateway to favorable interest rates, loan approvals, and financial opportunities. By comprehending the components that influence your score and implementing sound credit management practices, you can take control of your financial future and work towards achieving a healthier credit profile.

UK Economy Contracts by 0.3% in Q1 2023: Impact of Ukraine Conflict and Cost of Living Crisis

China's Economic Growth Slows to 0.4% in Q2 2023 Amidst COVID-19 Lockdown and Global Headwinds

Bangladesh Bolsters Ties with GCC in Readiness for Anticipated Ministerial Conclave