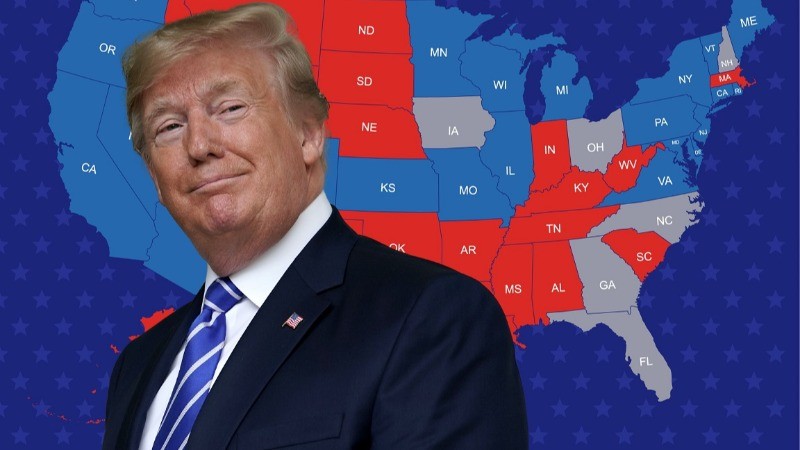

As the 2024 presidential election nears, signs are emerging that suggest a possible shift toward Donald Trump, with the so-called "Trump trade" gaining momentum. Slight changes in the polls, especially in key swing states, could significantly influence the outcome, highlighting the peculiar nature of the U.S. Electoral College system.

While nationwide polls still show Kamala Harris with a slight lead, her advantage has narrowed. Notably, Trump's leads in swing states like Georgia and North Carolina have strengthened, while Harris' previous leads in Michigan, Pennsylvania, Wisconsin, and Nevada have either diminished or disappeared.

According to the latest analysis from 538, Trump now holds a 52-in-100 chance of winning, a reversal from just two weeks ago when Harris was seen as the front-runner with a 58-in-100 chance. However, the race remains highly competitive, and these numbers could shift again in the coming weeks.

Betting markets, often seen as more accurate than polls due to the financial stakes involved, have also shown shifts in Trump's favor. However, recent large bets on these platforms have raised concerns about the influence of a few wealthy individuals swaying the odds.

Financial markets are also closely watching the election, with trillions of dollars potentially on the line depending on the next president's policies. Stanley Druckenmiller, a prominent hedge fund manager, recently pointed to market trends that suggest investors believe Trump may win the election.

The "Trump trade" serves as a key market indicator. Earlier this year, when Trump seemed to have a strong chance of winning, the U.S. dollar, Treasury yields, Bitcoin, and shares of Trump Media all saw gains. After Joe Biden stepped aside and Harris took his place on the Democratic ticket, these assets retreated. However, since October, the Trump trade has bounced back.

The U.S. Dollar Index has risen 2% this month, while the 10-year Treasury yield has surged by 40 basis points. Analysts attribute these moves to expectations that Trump's policies, including tariffs and tax cuts, could boost the dollar and increase U.S. debt, pushing bond yields higher.

Bitcoin has also jumped by 12% in October. Trump has positioned himself as a supporter of the cryptocurrency industry, a shift from his earlier criticism of Bitcoin.

Shares of Trump Media, the parent company of Truth Social, have soared by 83% this month. The stock has been a barometer of Trump's election prospects, with significant spikes during key campaign moments, such as after Trump's debate performance and following an assassination attempt earlier this year.

Despite these gains, not all sectors linked to Trump's potential victory have performed uniformly. Energy stocks, which could benefit from reduced regulation under a Trump administration, have remained relatively flat due to external factors like fluctuating oil prices. Meanwhile, financial and healthcare stocks, which could also see lighter regulation, have seen mixed results. While bank stocks have surged on strong earnings reports, insurance stocks have declined following weak guidance from major players.

As the election approaches, both financial markets and political analysts will continue to closely monitor these indicators, as they offer a glimpse into the potential outcome of the 2024 presidential race.