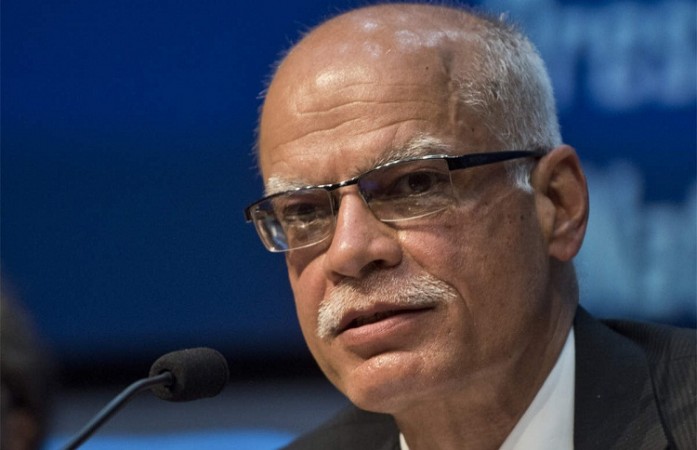

Revenue Secretary Tarun Bajaj said, more exemptions will be eliminated under the Goods and Services Tax (GST) system, particularly in the services industry.

Addressing a CII interactive session, Bajaj said a lot of work still needs to be done to prune GST-exempted items, particulary in the services sector, Revenue Secretary Tarun Bajaj said on Tuesday. The effort is to remove the "rough edges" in Goods and Services Tax (GST) over the next two-three years.

On rationalisation of GST rates, Bajaj said a group of ministers is looking into it. "We will have to wait for some time," he said. Exemptions still remain, a large number on the services side, Bajaj said, adding "work needs to be done to prune it".

On representations that 5 percent GST on non-ICU hospital rooms above Rs 5,000 is against affordable healthcare, the revenue secretary said the percentage of rooms in hospitals which charge more than Rs 5,000 is "minuscule". "If I can spend Rs 5,000 on a room, I can pay Rs 250 for GST. I don't see any reason for such a messaging that 5 per cent GST is hitting affordable healthcare," he added.

States to encourage farmers to increase paddy, wheat sowing: Goyal

How does PLI scheme add GDP annually?

A record USD 25.6 billion trade deficit was recorded in June