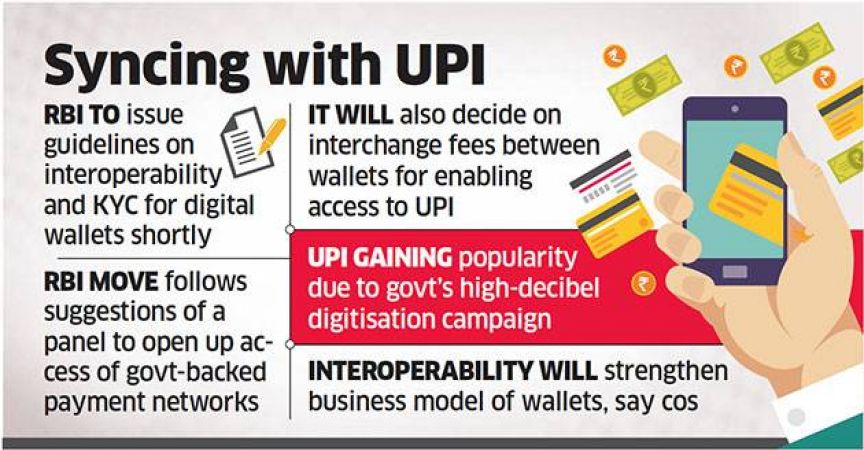

MUMBAI: Digital wallets will get an open nod from the RBI, as the latter agrees to open the Unified Payment Interface platform for them as part of the government's digitization campaign. Digi wallets such as the Paytm & Mobikwik will be allowed to operate on the UPI platforms under the RBI norms. RBI will be issuing guidelines on the standard operating procedures(SOP) and the 'KYC' guidelines for the digital wallet companies. Interchange fees will be also applicable between the wallets for them to access the UPI platform.

Digital wallets can gain access to the UPI platform via partner banks to transact bank-to-bank money transfers. With Direct access users from wallets like PhonePe can be able to transact or send money to other users, merchants on the different platform like paytm, mobikwik, oxygen expanding the features of the digital platforms.

Digital wallets are popular and have more users but UPI which has only a bank to bank transfer functions is gaining support from the people because of the government's digital India campaign transforming the economy into a digital or cashless based economy. Other platforms which the government is keen to promote is Aadhaar-based payment platform and transactions using QR codes.

The RBI moves came after the recommendations of the government-constituted Ratan Watal committee on Digital payments. In the December report, the committee said to open access between the government-backed payment networks to non-bank service providers. RBI's decision must also be taken with slow adoption of the bank-led UPI apps and the poor technical abilities of mid-sized & small banks.

The government's BHIM app for UPI transactions has been given a download hit of 17 million tires since its inception in December 2016. RBI data showed that UPI network tacked 4.2 million transactions amounting Rs. 1,900 crore in February & a similar 4.2 million transactions amounting Rs. 1,660 crore in the January month, pointing increasing using of the platform with ease. But on the other hand, the Digital wallets transactions data amounts to a huge 261.67 million transactions amounting Rs. 8,350 crore in January.

Also, read:

Reliance Jio, Paytm apologise for using PM Modi's photograph without permission

Paytm rolls back 2% fee for recharge via credit cards

Paytm to charge 2% for recharge using credit cards