Life insurance holds an immense value for a family that only has one earning member. Consider a scenario wherein the breadwinner loses his or her life due to deteriorating health or an accident. While the family has to deal with the emotional trauma of losing a loved one, they will also have to suffer financial stress, as they cannot rely on anyone else for support. To make sure that your family doesn't have to go through a similar chain of events, you need to create a contingency plan, with life insurance at its foundation, and various other investments making up the remaining portfolio.

Having a comprehensive life insurance plan in your kitty, you can not only provide the right financial support to your loved ones in case of emergencies but also earn long-term tax-saving benefits among others for yourself. Before you purchase an insurance plan; however, you need to compare different life insurance plans from reputable insurers such as Max Life Insurance, on the basis of their claim settlement ratio. This way you will be able to select an insurance cover that suits your present liabilities and life goals perfectly. Why claim settlement ratio, you ask? Well, here's why.

What Is A Claim Settlement Ratio?

Insurance companies follow certain rules and regulations before settling an insurance claim, in case a policyholder passes away during the policy tenure. It is possible for the claims to be denied, especially when there are some red flags in the policy draft that might go against certain policy requirements. When it comes to life insurance; therefore, you need to be sure that you fill out the necessary paperwork correctly and choose an insurer that has a proven track record of settling the major portion of the claims received, on a year-on-year basis.

Claim Settlement Ratio can serve as a reliable metric to determine if a certain policy and insurer is the right choice for you or not. The ratio is calculated by dividing the number of insurance claims settled by the number of insurance claims received by the insurance company. Ideally, you should go for an insurer with a high claim settlement percentage or CSR.

How is Claim Settlement Ratio Calculated?

First, you need to understand that the Claim Settlement Ratio is calculated for all the insurance products offered by the insurance company put together, and not any specific product. Consider the following example to understand the calculation of CSR: Let us say that a life insurance company receives 1,000 claims, within a year, out of which it settles 987 claims by paying the insurance benefit (or sum assured) while rejecting the remaining 13 claims.

The Claim Settlement Ratio for the company would be (987/1000) % or 98.7% Overall, higher the percentage of the settled claims, the better are the chances that your life insurance policy claim will be accepted and settled by the insurance company. Another reflection of a high CSR is on the insurance company's finances. With settlement percentages up and above the 95% mark, a prospective life insurance buyer can be sure that the insurer's finances are secure as they are willing to pay the insurance claim amount to most of their customers.

Be Sure of Your Family's Financial Future

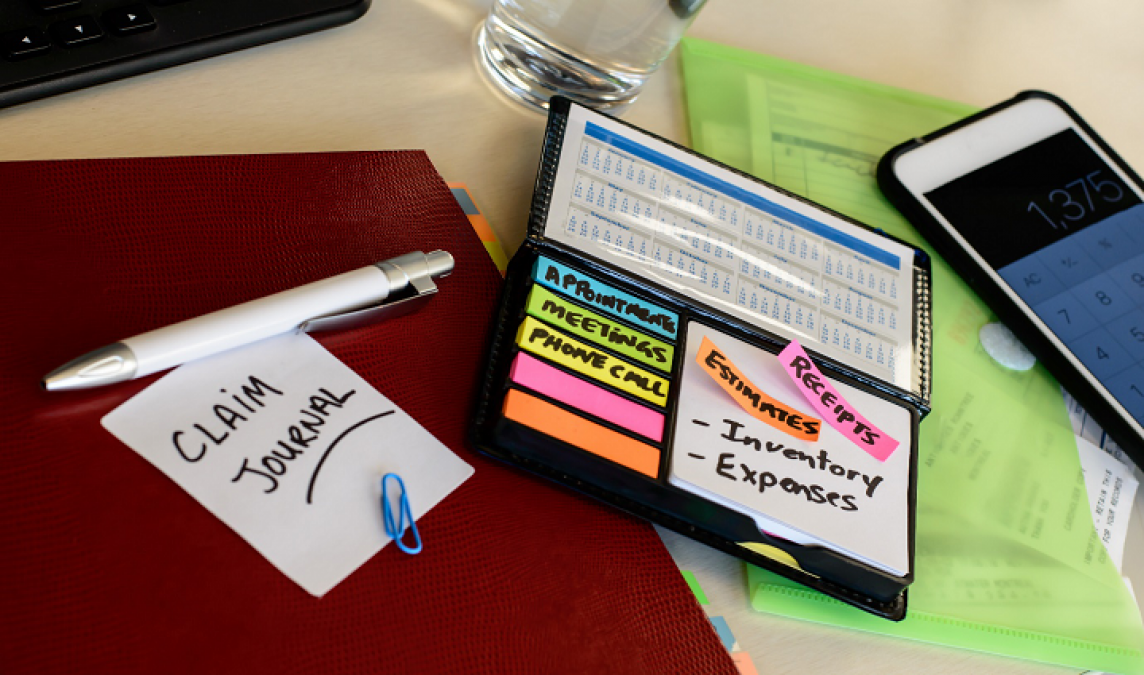

(image source: Shutterstock)

Buying a life insurance policy or any other investment plan for child education is a long-term endeavor. Not only do you have to pay a significant amount of premiums over a specific payment tenure to avail the policy benefits, but you also have to be sure that your insurance policy documentation is well-rounded so that it doesn't get rejected.

Thus, you need to compare and purchase a life insurance plan from an insurer with a high claim settlement ratio. CSR is a reliable metric that can help you determine if a certain insurance company is trustworthy or not and that your family will not have to move from pillar to post in getting the insurance benefit, after your untimely demise.

Good News! Petrol can be quite cheap, the government has taken a big step

IRCTC Vikalp Scheme: Know when and how to avail this scheme

AirAsia flights to Ahmedabad will be available from these cities