Nicaragua: Through five potential new trade deals with countries in Latin America that were once predominantly US backyards, China will secure prized natural resources while competing with the US for allies, analysts believe.

According to the government's trade ministry, Beijing officials began talks with Ecuador in June, and South American media reports indicate Uruguay is moving forward with its trade deal with China – the Mercosur or Southern Common Market Negotiating Bloc.

Despite opposition from the United States, which it shares with Argentina, Brazil and Paraguay.

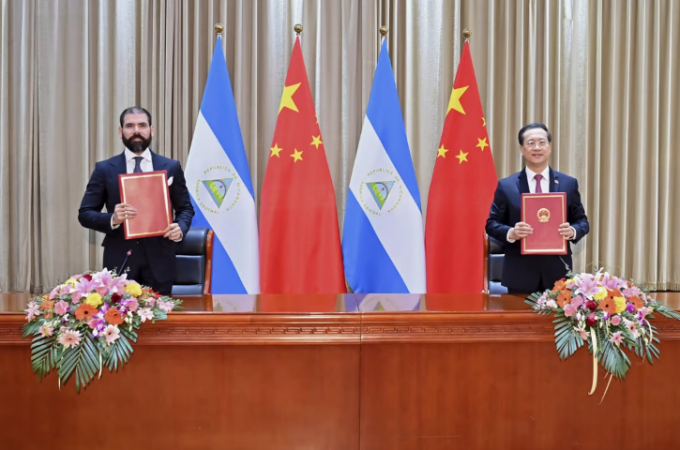

According to the website of the Chinese Ministry of Commerce, an agreement with Panama is "under negotiation" and China is conducting a joint feasibility study towards an agreement with Colombia. According to the ministry, China and Nicaragua signed an "early harvest arrangement" for a free trade agreement last month.

Chile, Costa Rica and Peru have already signed trade treaties with China, starting with Chile in 2005 offering potentially lower import tariffs, while also attracting investment from another country. Areas have also been opened.

According to author and former Chilean ambassador to China Jorge Heine, "China's presence in the region in the new century is perhaps the most important new factor in the international political economy of Latin America in its two centuries of independence."

The United States was Latin America's primary trading partner until 2001, when China joined the World Trade Organization, keeping all Chinese trade deals within an internationally recognized legal framework.

From the start of the Cold War in the late 1940s to the collapse of the Soviet Union in the early 1990s, Washington counted much of Central and South America as political allies.

According to Evan Ellis, a research professor of Latin American studies at the US Army War College's Institute for Strategic Studies, by 2015 the US had "effectively lost its important role with every country south of Costa Rica".

According to him, Latin American leaders are now turning to China's large, fast-growing market for exports such as minerals and agricultural products.

According to Ellis, countries with left-wing governments have adopted China faster than neighbors with more conservative leaders.

According to Hein, South and Central America and the Caribbean traded $10 billion with China in 2000 and $451 billion last year.

Strong ties in South and Central America have also allowed China to compete with the US for global influence, despite the two countries' four-year trade dispute that has hampered Chinese exports and other economic disruptions between the two. . because of.

Trade deals with China would be possible if the US ever forced Latin American countries to choose between ties with Beijing and ties with Washington, according to Asia-Pacific trade analyst Nick Marrow of The Economist Intelligence Unit market research firm will be in favor. Hong Kong. At present, the US does not advise Latin American countries to avoid doing business with China.

Marrow said China largely sees its participation in the Southeast Asia-led Regional Comprehensive Economic Partnership and other agreements as a means to counter US international influence.

Meanwhile, Beijing is exploring deeper economic ties in the South Pacific and Africa.

According to experts, China will gain access to minerals in the US, as well as new jobs for Chinese infrastructure developers such as Huawei Technologies Co and new markets for Chinese manufactured goods.

According to Ellis, it could obtain oil from Ecuador and wool from Uruguay. As a manufacturing hub with 1.4 billion people, China needs various resources for economic development as well as population support.

"They don't have enough to support rapid growth," said Edwin Lai, associate director of the Hong Kong University of Science and Technology's Center for Economic Policy.

Analysts believe that Latin American countries are primarily interested in the Chinese market.

"Beijing hopes that if the United States ever pressures Latin American countries to choose between a relationship with China and a relationship with the United States," Marrow said.

According to Ecuador's trade ministry, non-petroleum exports surpassed US$3.6 million last year, with China ranked second. Non-petroleum exports to China stood at more than US$2.3 million from January to July this year, representing a 110 percent increase over the same period in 2021.

Hein said Ecuador and Uruguay first approached China to propose trade agreements.

"Beijing responded positively, which is in line with China's commitment to free trade," he said. "As it happens, both countries have proposed such [free trade agreements] to the United States, but Washington has rejected them." However, according to Ellis, some Latin American leaders have unrealistic expectations from China.

They may believe, based on a trade agreement, that Chinese consumers will buy their country's banana crop duty-free, when in fact China can save money on transportation by ordering the fruit from a nearby Asian country.

He said Chinese trade negotiators have more experience with trade deals than many Latin American counterparts. He claims that some Latin American leaders sign agreements that benefit only a small wealthy section of their countries.

According to Ellis, the most talked-about exports to Chile are cherries and grapes, but the most valuable is copper, which is so valuable that China has attempted to penetrate deeper into the region than Chile is willing to allow.

According to the UN COMTRADE database, the South American country's copper exports to China stood at about US$8.2 billion last year.

According to Hine's calculations, bilateral trade between Chile and China increased from US$8 billion in 2005 to US$55 billion last year.

Mount Everest climber missing from China border, no info from 7 days

Risk of military clash in Taiwan and China is increased after Taiwan shot down china's drone