China: China has lowered a key policy interest rate by 10 basis points, the first reduction since mid-January, as economic pressure from coronavirus outbreaks continues to weigh on the country's economy and as tensions with the US remain high following a string of high-profile visits to Taiwan this month.

When selling 400 billion yuan (US$59.3 billion) of the tool on Monday morning, the People's Bank of China (PBOC) unexpectedly reduced the rate of one-year medium-term lending facilities to 2.75 percent from 2.85 percent.

According to the central bank's statement posted online, the action will fully satisfy the needs of financial institutions.

The seven-day reverse repo, another significant policy rate, was also lowered from 2.1% to 2.0%.

The rate reductions, which will stimulate economic activity, were announced as July data from the National Bureau of Statistics, which was released on Monday, showed troubling trends, including still-weak consumption.

According to government data, the growth of retail sales, a measure of domestic consumption, slowed to 2.7% last month from 3.1% in June.

The growth of fixed-asset investments from January to July slowed to 5.7% from 6.1% growth in the first six months, and fixed-asset investments still lagged. Growth in industrial output slowed to 3.8% in July from 3.9% in June.

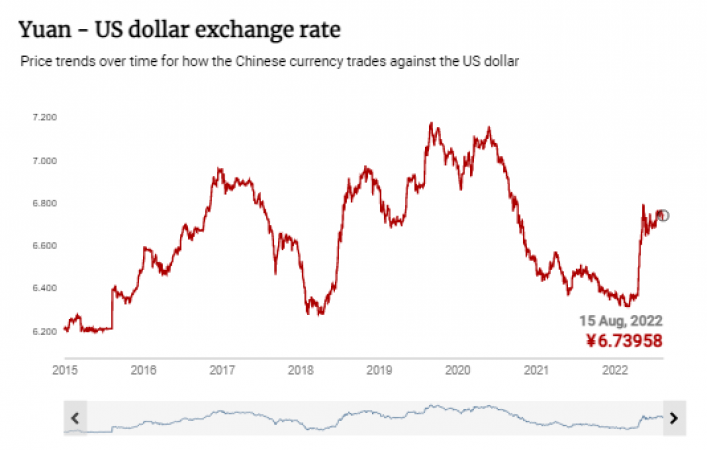

Comparing the loosening PBOC policy to the much more aggressive rate hikes in the US and other Western economies would put more pressure on China in terms of international capital flows and the value of the yuan, but these considerations seem to have given way to growing concerns about the downward pressure on the economy.

The Chinese economy was already alarmed by the July lending data that came in lower than anticipated.

As the coronavirus pandemic has had a severe impact on Chinese businesses and individuals, new bank loans last month fell 37.1% from a year earlier to 679 billion yuan (US$100.7 billion), indicating rather weak domestic demand.

At its quarterly economic analysis conference at the end of July, China's top leadership insisted on finding a balance between growth, pandemic prevention, and development security. However, despite promising to achieve the best economic result for the year, they failed to mention the "around 5.5 percent" annual growth target.

The second-largest economy in the world is anticipated to fall short of the yearly goal after reporting only a 2.5% growth in the first half of this year.

China manipulates its population by instilling fear that everything they do is being watched

How Pelosi's visit to Taiwan sparked new round of electronic warfare between the US and China

50 million vacant apartments pose threat to China's already unstable real estate market