BEIJING: Chinese missiles flying over Taiwan and a naval exercise simulating a Chinese blockade in the Taiwan Strait in August have shocked the semiconductor industry to consider a scenario that previously seemed impossible: the core chip -The war on the productive island.

According to 15 semiconductor executives contacted by Reuters, some businesses are now considering how to respond if China strikes or restricts access to the democratic island, including developing contingency plans and trying to protect Taiwan. Involves asking about manufacturing capacity outside.

Also Read: China conducts anti-submarine exercises as neighbors beef up their underwater forces

The war game rattled nerves in early August following a visit to Taipei by US House Speaker Nancy Pelosi, who asked to remain anonymous because they were concerned about ties with China, according to officials. Taiwan has been under Chinese threat for decades, with occasional spikes in tensions.

China considers Taiwan as its own. Taiwan's government has denied China's claims of sovereignty.

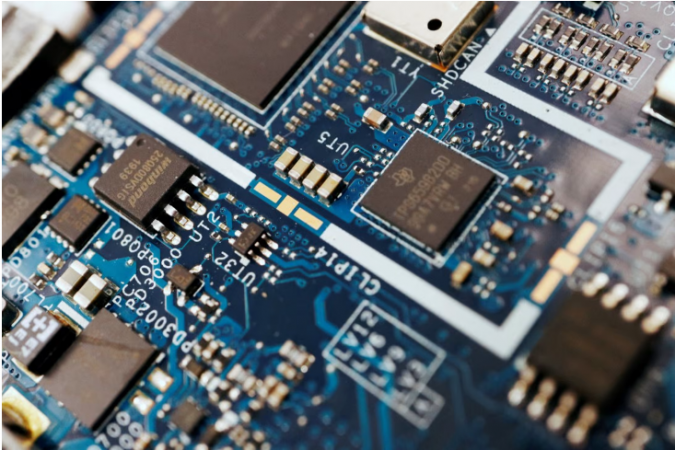

Taiwan is home to Taiwan Semiconductor Manufacturing Company (TSMC), the largest contract chip manufacturer in the world and a supplier of well-known brands such as Apple, US chip maker Nvidia and Qualcomm. Taiwan produces the vast majority of the world's most sophisticated chips. Everything from iPhones and washing machines to cars and fighter jets depends on chips.

Officials acknowledged that weaning the world from Taiwan's high-tech chips will take time, but the region faces growing geopolitical challenges.

According to Terry Tsao, President of SEMI Taiwan Industry Group, business continuity plans are currently a hot topic. "Only a few businesses have started to develop these plans. Most I hear are foreign corporations.

The American Chamber of Commerce in Taiwan surveyed respondents a week after Pelosi's visit, and 40% of those surveyed said their companies had revised or modified the continuity of their crisis contingency or operations plans in Taiwan.

A senior executive of a large foreign company with operations in Taiwan claimed that his clients had inquired about his company's business continuity plans and that they had asked their Taiwanese suppliers the same questions.

He claimed that until recently, "no one has actually uncovered any sort of military action in their business continuity plans." He added: "I don't think anyone believes the political climate is going to get better." The management began preparing for supply disruptions and other scenarios after becoming uncomfortable with the Chinese practice that showed how easily Taiwan could be intercepted.

Also Read: Taiwan's Navy introduces a new amphibious ship

Some claim that Taiwan's proximity to chip makers acts as a "silicon shield", preventing China from allowing the island and the United States to pass into Chinese hands. Although the Taipei government has downplayed this theory, it is keen to avert any decline in its vital semiconductor industry.

At a closed-door AMCHAM event later in August, representatives from Taiwan's Ministry of Foreign Affairs, the Economy and top military think tanks argued for the island's continued status as a safe place for chip investment.

After the US-China trade war began, many Taiwanese non-chip tech companies resumed manufacturing or moved to Southeast Asia as their customers in the US or Europe asked them to diversify away from China, Newberger said. According to Sebastian Hou, senior investment analyst at Berman in Taipei.

Although immediate action has not been requested by their Western customers, some discussion is already underway, according to Hou, following Pelosi's visit, "customers from the Western world expressed their concern about being too concentrated in Taiwan. expressed."

After Pelosi's visit, more companies with factories outside Taiwan approached a foreign chip executive, but those meetings had yet to result in any new orders. He opted not to mention the companies in question.

The executive explained that people are asking themselves, "If I have options, where else can I go to make sure that my device -- my supply chain -- has options if the missiles start flying?

These customers are looking for chips made from older technology because, according to the executive, TSMC is the only company that has the production capability to supply leading companies when it comes to cutting-edge technology.

Executives told Reuters that given the high costs in countries such as the United States, it would be challenging to replicate the efficiency of Taiwan's semiconductor industry, which is home to the chip giant and hundreds of their suppliers together on the island's west coast. has been grouped.

While the drills were forcing a closer examination of the risks of potential future investments there, a senior executive at another significant foreign chip company with operations in Taiwan stated that withdrawing was not an option.

The business or financial terms continue to be much more important, he claimed. According to Kung Ming-hsin, minister of Taiwan's National Development Council, major chip companies, including foreign ones, will invest roughly US$210 billion in advanced manufacturing in Taiwan over the next five years.

Merck, a major manufacturer of chip materials, is increasing its investment. Merck revealed a 500 million euro investment in Taiwan over the following five to seven years last year.

After Pelosi's visit, John Lee, managing director of Merck Group in Taiwan, told Reuters that the company has no plans to veer from its current course because chip demand is increasing rapidly and Taiwan is still the world's largest market for semiconductor materials.

One executive at a significant Taiwanese technology company claimed that after the drills, the company began to publish daily geopolitical reports to reassure foreign clients that it was taking the issue seriously rather than because it was worried about the possibility of war. The executive said, "Taiwan is used to this, but if you are sitting in the C-suite overseas, it's much more alarming."

Also Read: Future Italian PM Meloni is prepared to sour relations with China

However, a senior executive at another Taiwanese chip company claimed that despite the military tensions, his company has not yet experienced significant pressure from foreign clients.

They realise that there isn't much we can do, no matter how much they try to pull our strings, the executive said.

Taiwanese chip companies have increased their foreign investments in recent years, but executives and analysts claim that the planned capacity still represents a small portion of their total output.

Miin Wu, the chairman and CEO of Taiwanese chip manufacturer Macronix International Co, responded to a question about how cross-strait tensions might affect his company's operations last month by saying, "Of course we worry about it. He did, however, add that fretting was useless. Instead, he said, "we just keep investing and make better and better products."