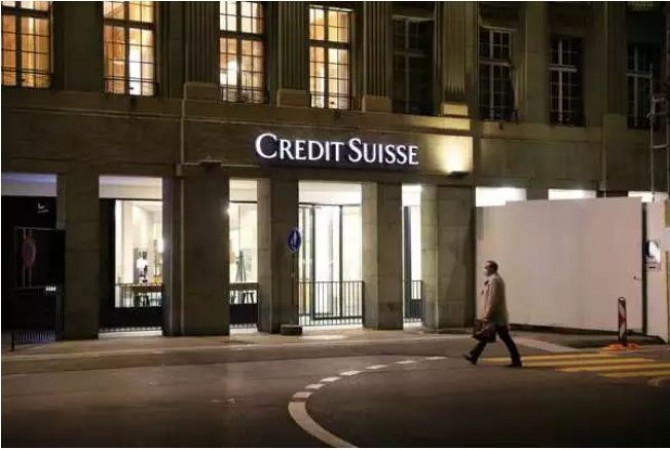

NEW DELHI: A report by The Swiss Financial Market Supervisory Authority FINMA claims that Credit Suisse ignored over 100 warnings of potential breach of regulations.

Swissinfo quoted that the NZZam Sonntag paper as reporting that the management of Credit Suisse had overlooked breaches of regulations for years and that bank leads the pack when it comes to the most ongoing FINMA investigations.

In recent years, FINMA has initiated five proceedings against the bank to remedy these omissions. The most recent cases concern the billions lost via the Greensill and Archegos funds. There have also been investigations into money laundering and executive espionage. A report shows that Credit Suisse ignored more than 100 red flags in total, the report said.

The SonntagsBlick paper highlighted one such red flag around the time when Urs Rohner was head of the board of directors. It concerns a client advisor who managed the funds of wealthy Eastern Europeans that earned the bank some 25 million Swiss francs a year.

According to the SonntagsBlick, he was alleged to have invested his clients' assets in high-risk investments without their knowledge, falsified documents and lined his own pockets in the process. Despite warnings, he allegedly continued to work for the bank and was only fired in 2015 after making massive speculations.

UK economy projected resilience ahead of big lockdown easing

Will India fall into the pit of 'poverty', will the economy disintegrate? Read UN statement

Economic outlook: India is expected to grow 10.1 pc in 2022, outlook for 2021 is very fragile: UN