New Delhi: The Reserve Bank of India warned on Wednesday that the strengthening of inflationary impulses, together with global price shocks, pose upward risks to the inflation trajectory forecast for April.

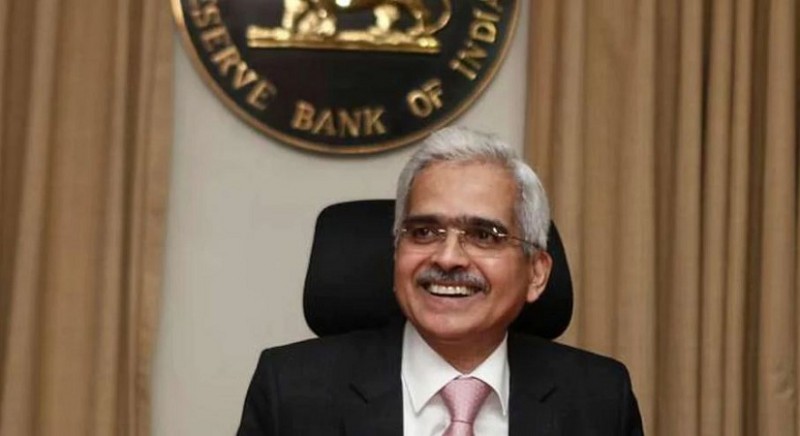

CPI inflation, which hit a 17-month high of 6.95 percent in March, is expected to stay high in April, according to RBI Governor Shaktikanta Das, who announced the results of an off-cycle Monetary Policy Committee meeting. "There is a concern that if inflation stays at these levels for too long, it will de-anchor inflation expectations, which will then become self-fulfilling and harmful to growth and financial stability," Das added. "Hence, we must remain prepared to deploy all policy levers to maintain macroeconomic and financial stability while increasing the economy's resilience," the governor added.

The RBI's rate-setting panel unanimously opted to raise the policy repo rate by 40 basis points to 4.40 percent in an off-cycle meeting. The group also agreed to continue to be accommodating while concentrating on the removal of accommodations. The unexpected increase comes only hours before the Federal Open Market Committee meeting in the United States, which is set to take place later today.

The Federal Reserve of the United States is largely predicted to raise interest rates by 50 basis points. Das said, global supply chain delays and uncertainties caused by the Russia-Ukraine conflict provide an upside risk to the April inflation forecast.

EMIs to go up RBI hikes repo rate by 40 bps

MPC meet: RBI Governor announces hike in interest rate by 40 bps to 4.40 pc

Sensex Dives 1307-pts as RBI Hikes Interest Rate In Off-Cycle Move, Nifty Below 16,700