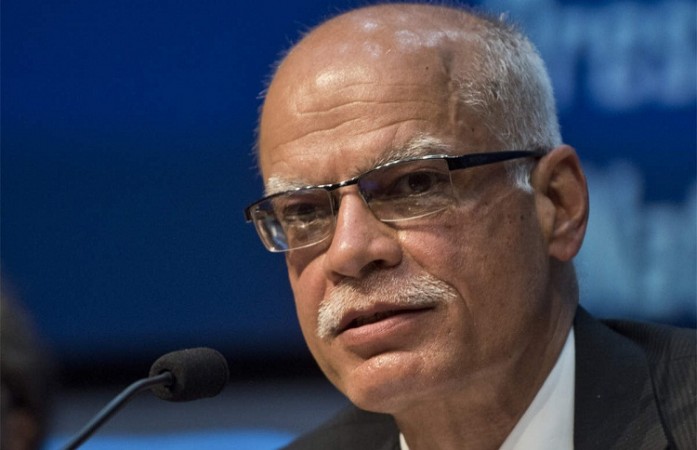

New Delhi: The government is expected to make adjustments to the Goods and Services Tax (GST) structure this year, according to Revenue Secretary Tarun Bajaj.

"Government realises that GST rates on certain products need to be brought down to bring equity," Bajaj said during an interactive session on Union Budget 2022-2023 organised by industry organisation Confederation of Indian Industry (CII).

"We are open to look at the ideas of the restaurant business," he continued, noting that the industry had proposed that if they received an input tax credit, they could return to a higher rate.

The tax already paid by a person at the time of purchase of goods and services, and which is available as a deduction from tax payable, is referred to as input tax credit (ITC). It means you can deduct the tax you've previously paid on inputs and pay the difference when paying tax on output.

Bajaj further stated that if the Finance Ministry has to make changes to the coal cess, it will have to go back to the GST Council. "I take the idea that 28 percent GST on high efficiency inverter ACs needs to be decreased," he added.

Inclusion of Aviation Turbine Fuel to raise in GST in next Council meet: FM