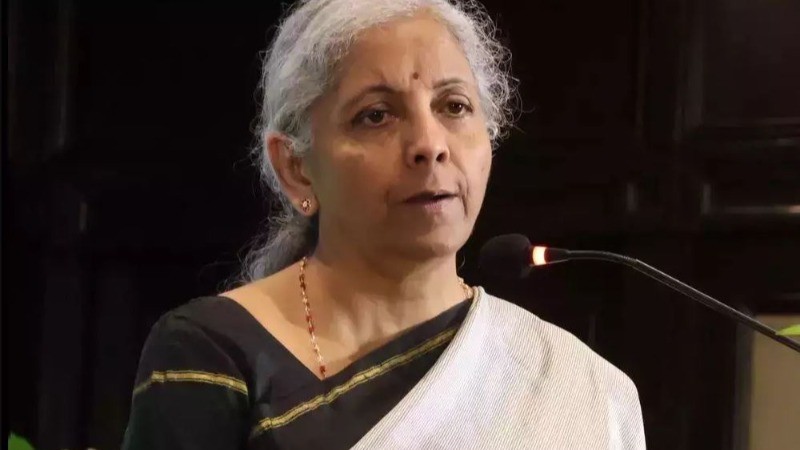

The 54th meeting of the Goods and Services Tax (GST) Council, led by Union Finance Minister Nirmala Sitharaman, concluded with key decisions aimed at improving the efficiency of the tax system while offering relief to various industries. Held at the Sushma Swaraj Bhawan in New Delhi, the meeting brought together officials from the finance ministry and state finance ministers to address several critical issues.

One of the major highlights was the announcement of a 412% increase in GST revenue from online gaming and casinos, amounting to Rs 6,909 crore over the last six months. This growth follows recent tax changes that expanded the GST scope in these sectors.

To provide further support, the Council has set up a Group of Ministers (GoM) to examine the possibility of reducing GST rates on health insurance premiums. The report is expected by October, with final decisions to be made in the November meeting.

In an important healthcare move, the GST on cancer drugs was reduced from 12% to 5%, making treatments more affordable for patients. Additionally, the tax on certain snacks was lowered from 18% to 12%, offering relief to consumers.

International airlines also received relief, as the Council exempted them from GST on the import of services, helping to reduce operational costs. Universities and research centers supported by the government or with tax exemptions are now free from GST on research grants, benefiting academic institutions across the country.

The Council discussed cess collection, projecting Rs 8.66 lakh crore in total collections by March 2026, with a surplus of Rs 40,000 crore after loan settlements. A new GoM will decide the future of cess collection beyond March 2026.

To address tax system imbalances, a committee led by the Additional Secretary of Revenue will focus on resolving the negative Integrated Goods and Services Tax (IGST) balance and recovering excess funds disbursed to states. Further discussions on rate rationalisation are scheduled for September 23.

The Council also took steps to prevent tax leakage by including commercial property rentals under the Reverse Charge Mechanism (RCM) if rented by an unregistered person to a registered one. Other decisions include Business-to-Customer (B2C) GST invoicing starting October 1, an increase in GST on car seats from 18% to 28%, and clarification that Roof Mounted Package Unit (RMPU) Air Conditioning Machines for Railways will attract a 28% GST rate.

Industry Leaders Welcome GST Council's Rate Cuts and Policy Changes Across Key Sectors

GST Council Defers Decision on Insurance Premium Tax Reduction

How the 54th GST Council Meeting Aims to Address Key Tax Issues