How Your Everyday Essentials Contribute to Govt Revenue: As we navigate our daily lives, we often overlook how much of our spending goes towards Goods and Services Tax (GST). Yet, from the smallest personal care item to big-ticket purchases, GST is everywhere, quietly but consistently contributing to the government’s revenue. This realization brings a mix of pride and concern – pride in being a part of the nation’s growth and concern about the cumulative impact on our wallets.

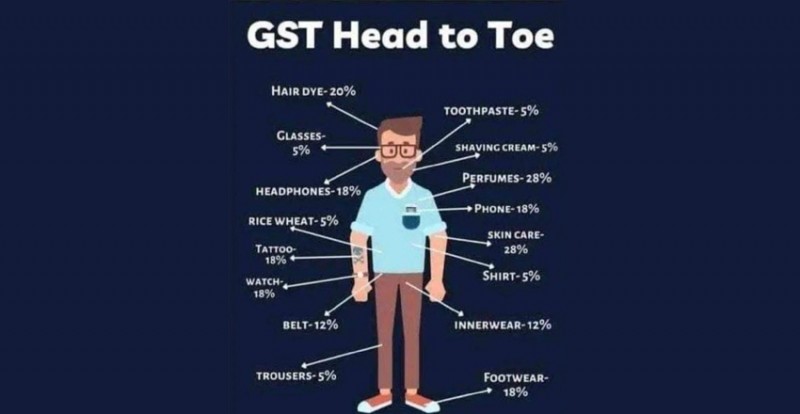

Let’s take a closer look at how GST is applied to our everyday items, from head to toe:

- Hair Dye: 20% - Adding a touch of color to your hair comes with a significant tax.

- Optics: 5% - A clearer view of the world is taxed lightly.

- Headphones: 18% - Immersing in music or calls carries a moderate tax burden.

- Rice and Wheat: 5% - Essential staples of our diet come with a minimal tax.

- Tattoo: 18% - Permanent body art also permanently leaves its tax mark.

- Watch: 18% - Keeping track of time has its tax implications.

- Belt: 12% - Keeping things in place with a belt involves a mid-range tax.

- Trousers: 5% - Dressing up your lower half attracts a minor tax.

- Toothpaste: 5% - Oral hygiene has a minimal tax load.

- Shaving Cream: 5% - Maintaining a smooth face is lightly taxed.

- Perfume: 28% - Smelling good comes with the highest tax rate.

- Mobile Phone: 28% - Staying connected is one of the most heavily taxed expenses.

- Skin Care: 28% - Keeping your skin healthy and glowing demands a high tax.

- Shirt: 5% - Dressing your upper body comes with a small tax.

- Inner Wear: 12% - Even essentials like undergarments aren’t free from tax.

- Footwear: 18% - Every step you take is taxed at a considerable rate.

Navigating the GST Maze: Tips for Smart Spending

- Budgeting: Make sure to prioritize essentials and allocate your budget wisely to manage GST's impact.

- Seeking Tax-Free Alternatives: Where possible, opt for products that attract lower or no GST.

- Utilizing Input Tax Credits: If you’re eligible, claim input tax credits to offset some of these costs.

- Supporting GST-Inclusive Pricing: Encourage businesses to offer prices that include GST to avoid surprises at checkout.

While the GST system may seem burdensome at times, it’s crucial to remember that each tax contributes to the nation’s growth. Being informed about these taxes helps in making better purchasing decisions, balancing your personal finances, and appreciating your role in nation-building. So, while you might feel the pinch, take solace in knowing that every rupee spent is a step toward the country’s development. Surviving the GST effect is about awareness, smart choices, and a touch of pride.

Latest Updates:

New Capital Gains Tax Structure: FM Sitharaman Explains Modi 3.0 Government's Strategy

Budget: No New Relief for EV Sector as Sitharaman Holds Back on FAME and GST Measures

Union Budget 2024-25: Keeping Balanced Approach to Growth, Job, and Investment, Says FM