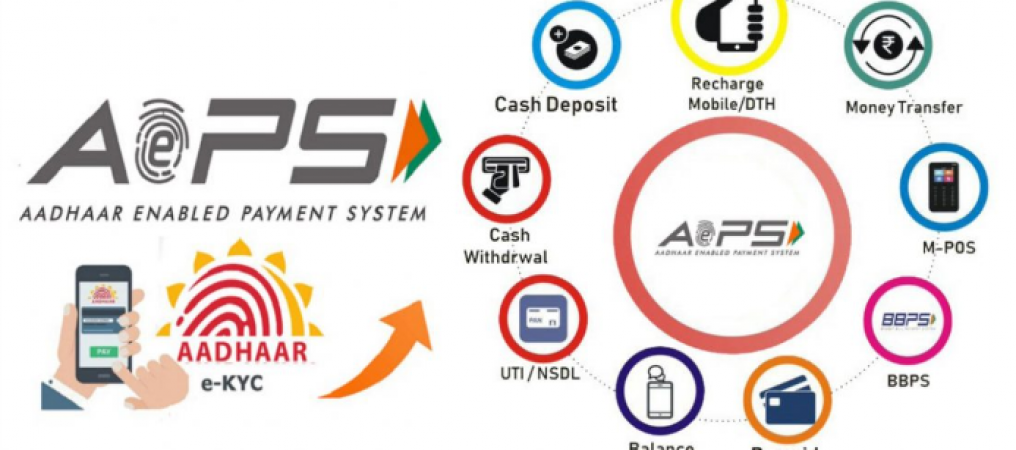

New Delhi: A type of digital payment system based on the Unique Identification Number is called Aadhaar Enabled Payment System (AePS) (UIN). Holders of Aadhaar cards are now able to transact financially using Aadhaar-based authentication.

By enabling universal access to banking and financial services via Aadhaar, AePS empowers all facets of society. It makes it simple to transfer money, make cash deposits and withdrawals, check your bank balance, and more.

India's steady transition to digital payments is proof of its advancement towards a cashless society. India saw a 33% year-over-year increase in the number of digital payments during the fiscal year 2021–2022. (YoY). During this time, nearly 7,422 crore digital transactions occurred.

Also Read: Christians in Palestine desperately wish for a tranquil and happy Easter

Customers can use AePS, a secure service, to conduct financial transactions by simply presenting their Aadhaar numbers at micro ATMs or points of sale (PoS).

Instead of asking for the customer's debit or credit card information, the AePS machine only accepts biometrics and their Aadhaar. As a result, it is required that Aadhaar be connected to the bank account. Users can access cash withdrawals/deposits, bank balance checks, Aadhaar-to-Aadhaar fund transfers, and other services with AePS.

The National Payments Corporation of India helped the Reserve Bank of India announce AePS.

Also Read: At least 23 migrants go missing and four perish in shipwrecks off Tunisia

Every segment of society should be able to access basic banking services, from rural areas lacking banks and ATMs to urban and semi-urban areas where finding a bank or ATM can be difficult.

AePS is now widely used in India to access banking services.

You can deposit cash, check balances, and more using AePS to digitally transfer money to bank accounts linked to your Aadhaar. Customers can conduct transfers using micro ATMs without going to a bank; instead, a Business Correspondent (Bank Mitra) helps them. Just go to the banking representative, give your Aadhaar number and the name of the bank, select the transaction type, supply biometric verification, and get your receipt.

The AePS service is a secure, convenient, and safe way to make payments online.

Also Read: Sudan's tense situation has alarmed the UN human rights chief

This system, which can be used with different banks, encourages financial inclusion and helps the underbanked segments of society. All users need is a bank account that is linked to their Aadhaar. Along with providing banking services, AePS also makes it easier for the government to pay out benefits under welfare programmes like NREGA, Social Security Pension, and Old Age/Handicapped Pension.