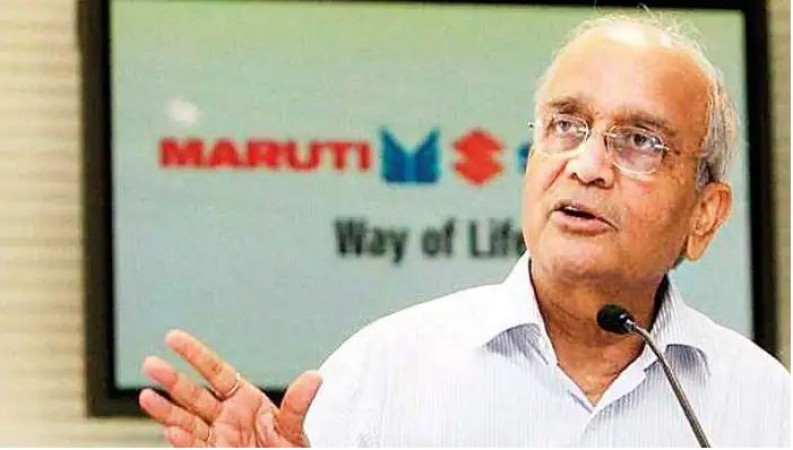

According to company chairman R C Bhargava, the largest automaker in the nation, Maruti Suzuki India, would struggle to regain a 50% market share in the domestic passenger vehicle market and will not "walk away."

The auto manufacturer, which is celebrating 40 years in business, saw its market share fall from a peak of 51.21 per cent in FY19 to 43.38 per cent in FY22.

The corporation intends to introduce models that are suited for both large and smaller cities as well as rural locations in an effort to regain its overwhelming leadership.

Domestic passenger vehicle sales in 2018–19 totalled 33,77,436 units, however, they fell to 30,69,499 units in 2021–22.

In 2018–19, Maruti Suzuki India sold 17,29,826 vehicles, setting a record for annual sales, and capturing a 51.21 per cent market share. At 13,31,558 units, it dropped to 43.38 per cent in 2021–2022

"We will fight to get back to our 50 per cent market share. How much we succeed only time will tell but we certainly don't intend to walk away and say no we don't want to fight for it. We will fight for our market share," Bhargava told PTI in an interview.

The corporation will release sports utility vehicles (SUVs) or any other body styles to the market to satisfy the customer in order to meet the sales targets, he continued.

"I believe the Indian customer has a lot of faith and a lot of trust in the Maruti brand and we will work to maintain the trust of the customer," Bhargava added.

The corporation will release sports utility vehicles (SUVs) or any other body styles to the market to satisfy the customer in order to meet the sales targets, he continued.

"Earlier it was a more homogeneous market when we started. One of the things we have to do now is to make sure that we have products for both segments of the market," he pointed out.

Bhargava admitted that "there has been a period in the last four or five years where we (Maruti Suzuki) haven't had adequate products for India' market."

"We are removing that deficiency," he added.

To increase its market share in the compact and mid-sized SUV segments, which are currently dominated by South Korean automakers like Hyundai and Kia, the business has planned a number of SUV launches.

Even domestic automakers Mahindra & Mahindra and Tata Motors have seen increases in market share as a result of their SUV offerings.

"So now we are clear that in India, there are these two markets and we have to have separate kinds of strategies for both markets," Bhargava said.

In response to a question on whether the carmaker will continue to produce tiny cars, he said that while some Indian buyers have become wealthier and can now purchase premium models, the majority still cannot afford pricey automobiles.

"Let's stay with the Bharat market. When can the Bharat market afford a Rs 10 lakh-Rs 15 lakh car or SUV? Till that happens, there's no option for them but a small car," Bhargava said, reiterating the company's commitment to also cater to the lower end of the spectrum with its small cars.

Many two-wheeler riders want to switch to vehicles, and their first preference will likely be modest, entry-level models rather than pricy SUVs, he said.

With a starting price of 3.99 lakh, the business recently introduced an entirely new model of the Alto K10, its entry-level hatchback.

Bhargava also argued that small cars offered a far safer ride compared to two-wheelers and it was important to keep the segment affordable.

Hero Electric customers can now get access to the Jio-bp charging network