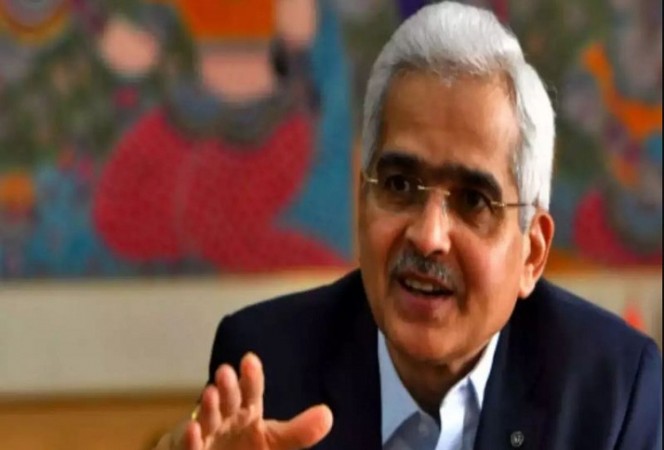

Shaktikanta Das, the governor of the Reserve Bank of India (RBI), gave a hawkish assessment of the economy and inflationary pressures today, but refrained from tightening monetary policy by raising interest rates.

Das has also chosen to maintain the accommodative stance, which means the RBI's surplus liquidity policy in the system would continue to boost growth. The RBI was expected to shift its stance from accommodating to neutral, implying that the system would remain in a marginal surplus. However, he has hastened the process of removing post-pandemic measures, causing a rate-distortion.

Maintaining the repo rate at 4% is a positive indicator for both retail borrowers and the government, which has a large borrowing programme planned for fiscal 2022-23. As they say, the future is full of surprises and very unpredictable, therefore central bankers must be prepared for future occurrences that will affect the financial markets and the economy.

In fact, the geopolitical risk arose precisely when everyone believed the COVID-19 virus had been defeated. The RBI has been compelled to make a significant downward revision to its real GDP and inflation predictions in less than two months.

RBI keeps repo rate unchanged at 4pc for 11th consecutive time

RBI MPC Live: Inflation pegged at 5.7pc in 2022-23, says RBI governor

RBI Monetary Policy: Governor Shaktikanta Das expected to keep rates unchanged