The Reserve Bank of India (RBI) is expected to hold the repo rate steady at 6.5 percent, marking the seventh consecutive time the central bank has opted not to change this key lending rate. Economists predict that the RBI-led Monetary Policy Committee (MPC) will maintain its stance on withdrawing accommodation.

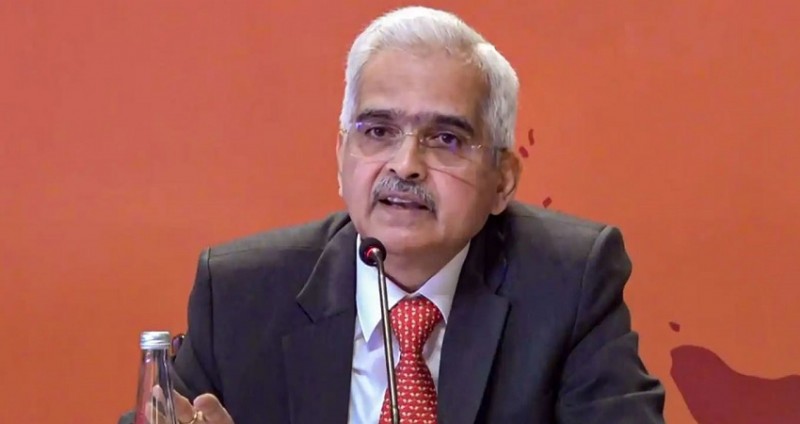

The repo rate, which determines the rate at which the RBI lends to banks, is likely to remain unchanged despite concerns over upcoming rains and heat waves. RBI Governor Shaktikanta Das is set to announce the decision on April 5 following the bimonthly meeting that began on April 3.

Economists, including Aditi Nayar from ICRA, suggest that the policy stance will remain unchanged until there is more clarity on the monsoon outlook. They anticipate that any adjustments to the policy may not occur until the August 2024 MPC review, awaiting further information on the monsoon, sustained economic growth, and decisions by the US Federal Reserve.

A majority of respondents in a survey conducted by ET expect the RBI to maintain its stance on withdrawing accommodation, preferring to monitor the progress of the monsoon before considering any shifts in monetary policy.

India is bracing for extreme heat during the April to June period, particularly affecting central and western regions. This may impact the agricultural economy and lead to inflationary pressures as commodity prices rise, according to the India Meteorological Department (IMD).

RBI Governor Das has consistently emphasized the central bank's commitment to reducing inflation to the 4 percent target. Despite fluctuations in food inflation, core inflation has shown a downward trend. However, concerns remain regarding the impact of weather variations on inflation and economic stability.

Analysts expect CPI inflation to moderate to 4.6 percent in FY25 assuming a normal monsoon, with inflation averaging 4.3 percent in the first half of FY25 and remaining between 4.5 to 5.0 percent in the second half. The possibility of above-average rainfall during July-September, as suggested by recent reports, further complicates the inflation outlook.

Barclays economists stress the need for the RBI to balance risks between over-tightening and maintaining conditions for robust real GDP growth, potentially around 7.0 percent.

Finance Minister Nirmala Sitharaman highlighted strong economic performance, with GDP growth exceeding 8 percent for the first three quarters of FY24. This trend is expected to continue, leading some economists to anticipate an upward revision in the RBI's growth projection for FY25.

Although consumer price inflation eased slightly in February, analysts expect a modest increase to 5.2 percent in March due to higher prices of vegetables and pulses.

Analysts eagerly await revisions in GDP forecasts, considering the better-than-expected growth performance in FY24. India recorded a robust 8.4 percent economic growth in the December quarter of fiscal 2023-24, with upward revisions in GDP estimates for preceding quarters by the National Statistical Office (NSO).

RBI's Policy Panel Begins Talks on Monetary Measures; Decision Due Friday

RBI Set to Decide on Interest Rates: What to Expect