New Delhi: Efforts are being made to overcome the economic crisis. The Reserve Bank of India (RBI) on Friday announced a 40 basis point reduction in the repo rate. Now the repo rate has been reduced from 4.40 percent to 4 percent. However, there has been no change in the reverse repo rate.

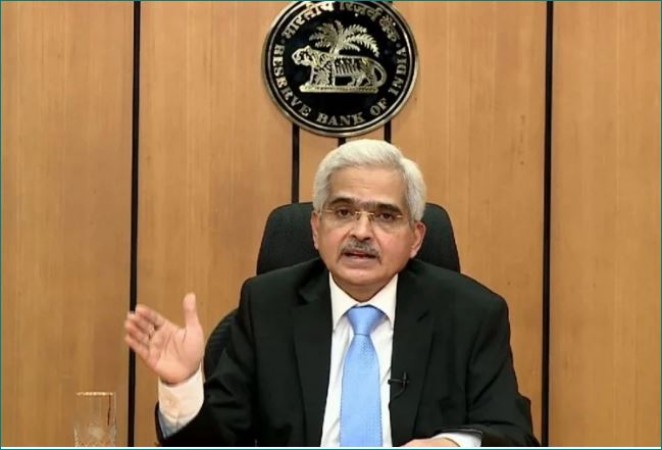

In a press conference on Friday, RBI Governor Shaktikanta Das said that the MPC has announced a reduction of 0.40 per cent in the repo rate. Now the repo rate has been reduced to 4 percent. This can have a direct effect on your EMI. Your EMI may be reduced. Explain that the repo rate is the rate at which the RBI gives loans to banks. Banks give loans to customers with this loan. Reduced repo rate means that many types of loans from the bank will become cheap, such as home loans, car loans etc. Now the repo rate has been reduced to 4 percent. With this, you can get loans at a cheaper rate.

RBI Governor Shaktikanta Das said on Friday that industrial production has come to a standstill in 6 major states due to Corona crisis and lockdown. Consumption of electricity, petroleum has decreased. Cement production fell 19 percent in March. There has been a huge decrease in investment in the country.

"Ration is not enough, laborers also need cash"- Raghuram Rajan

RBI director raised questions on Modi government's relief package

Airline companies started ticket booking, air travel may start from this day