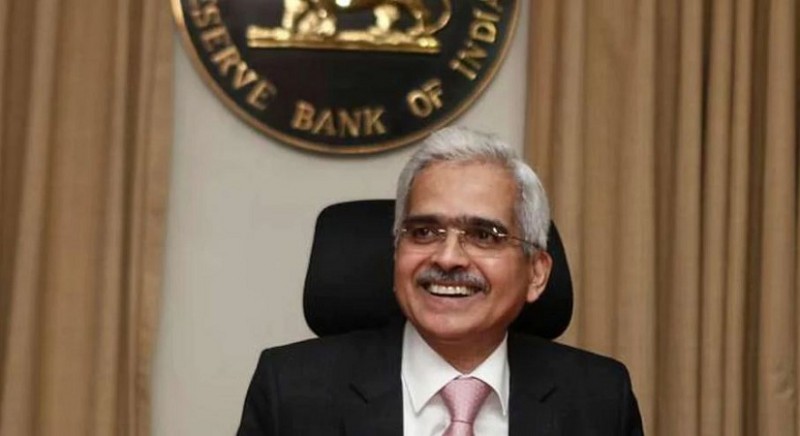

About six years after the launch of the Unified Payments Interface (UPI), RBI Governor Shaktikanta Das on Tuesday launched a new service that will allow over 40 crore feature phone users to access the popular digital transactions platform.

Within months of the launch of the main platform for smartphone users in 2016, the National Payments Corporation of India (NPCI), an RBI-sponsored body that created and operates UPI, launched a USSD-based service to enable UPI access for feature phone users.

However, Deputy Governor T Rabi Shankar stated that the service was found to be cumbersome, not free, and not supported by all telcos.

Das rued that the UPI's multifaceted features are currently available primarily on smartphones, and that people from the lower rungs of society, particularly in rural areas, are unable to access the payments service despite the fact that smartphones have become more affordable.

"With the launch of UPI 123PAY, facilities under UPI are now available to a segment of society that has previously been excluded from the digital payments landscape. In this way, it promotes a high level of financial inclusion in our economy," Das said at a central bank launch event attended by NPCI and bank officials.

He explained that the brand name is derived from the three-step process required to initiate and complete a payment.

PNB awaiting RBI guidelines on SWIFT transactions

Monetary policy is an art of managing expectations: RBI Das

License of this bank has been cancelled, depositors will get 5 lakh rupees!